The 18-foot kauri-clinker M-Class, first formed in 1922 following designs by Arch Logan and adopted by the Royal New Zealand Yacht Squadron.

The Emmy, as the M-Class Yacht is affectionately known, is one of the few traditional racing yacht classes that has survived the relentless march of progress. It is testimony to the quality of the Emmy and the dedication of those fine sportsmen committed to it that a class of expensive, wooden clinker boats continues to flourish in a world dominated by exotic, hi-tech materials and keel-boat racing.

Perhaps more than anything else, it is the comradeship that is at the heart of the Emmy’s appeal. For generations of yachties it has been the lasting friendships brought about by the close-knit racing and cruising scene that has made the class so special. At its cornerstone has been the unique facility of the Okahu Bay boat ramp where, with ten to fifteen boats and four or five crew each, the entire complement gather at the same rigging area both before and after the race.

Triumphs and disasters are a shared experience on each boat, to be related and embellished as everybody gathers to assist in the ritual of hauling out ‘the beasts’ over the sometimes treacherous slime on the ramp.

Of the Emmy’s contemporaries in the pre-war dinghy world, none remain. All three of the once- prolific 14-foot classes – T, X and Y – are gone, as has the 16-foot S-Class, which had its heyday in the years up to 1930. The unrestricted 18-foot V-Class, which in the early 1950s evolved into the spectacular Flying 18′s, hung on longest. But they too, have now gone the way of many other open-development classes, their decline hastened by the ever-increasing costs of new technology. (Not surprisingly, though, many of the older and sturdier V’s are still around the Hauraki Gulf, being cruised just as comfortably as always.)

Today the Emmy stands alone as the last of the big, unballasted centreboard dinghies racing on the Waitemata Harbour (or in the rest of New Zealand for that matter). Its survival appears to have been a subtle and finely tuned mixture of good design, tradition, comradeship and plain honest fun, coupled with the gradual introduction of modern ideas without ever sacrificing its ‘essential character’.

While nothing is ever certain, the future of the Emmy is at least promising.

Information courtesy of www.rayc.co.nz/mclass/

SHARE THIS:

- Yachts for Sale

Recently updated...

Write an Article

Covering news on classic yachting worldwide is a tall ask and with your input Classic Yacht Info can expose stories from your own back yard.

We are keen to hear about everything from local regattas and classic events to a local restoration or yachting adventure. Pictures are welcome and ideal for making the article more engaging.

With a site that has been created with the assistance of an international group of classic yacht enthusiasts we value your input and with your help we strive to make CYI more up-to-date and more informative than ever.

Please register and get in touch if you would like to contribute.

choose your language:

We’re passionate about Classic Yachts here at CYI, and we welcome submissions from all over the globe!

Captain, rigger, sail-maker or chef – if you’d like to write for CYI just let us know!

Email [email protected] to be set up as a Contributor, and share your Classic thoughts with the world.

ClassicYachtInfo.com has the largest database of classic yachts on the internet.

We’re continually working to keep it accurate and up-to-date, and we greatly appreciate contributions of any type. If you spot an error, or you have some information on a yacht and would like to contribute, please jump on in!

Don’t be shy…. Breeze on!

- Sell Your Yacht

Global Headquarters

Americas HQ +1 954.767.8305

European Head Office +41 22 518 01 19

Sydney AU Office +61 2 9979 2443

Auckland NZ Office +64 9 413 9465

View All Sales Locations View All Service Locations

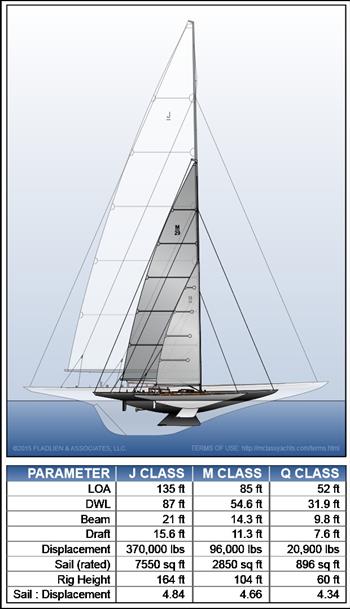

Outer Reef M Class

As the owner of an Outer Reef, you will rest assured your yacht is built to the highest standards possible, ensuring safety, fun and peace of mind. As Outer Reef continues the expansion of the Classic model collection, ensuring owners have a wide array of choices and opportunities, the resulting innovation and growth within the collection renders model organization within the Classic Series: X Class, M Class and S Class. What do Outer Reef Class Designations X, M, and S mean? Outer Reef class designations are determined by two factors: The yacht's beam dimension - Yachts within the M Class provide a beam dimension of 18' 6" (5.63 M). The yacht's dedicated mold - Each Outer Reef Classic yacht is built within one of three Classic Series molds, all differentiated by their beam dimension. Yachts built within the M Class mold are listed below.

720 / 740 Deluxbridge Motoryacht

700 / 720 Motoryacht

650 Motoryacht

- CLASSIFIEDS

- NEWSLETTERS

- SUBMIT NEWS

Two new M-Class yachts launched in style at Royal Akarana

Related Articles

Earwigoagin

Saturday, april 30, 2016.

- Header Photo: The New Zealand M Class

"Now to try and give you a hopefully " brief " understanding of the two photos and the origins of the class. The yachts concerned are M class which is a restricted center board class that sprang from a design by Arch Logan in 1922 for a prominent Auckland family for their two sons. The first named "Mawhiti" and the second "Manene" were launched in 1922 and made an immediate impression. They evolved into a class which attracted the interest of the Royal New Zealand Yacht Squadron ( the leading yacht club based in Auckland) . The "M" designation came from a decision by the Auckland Provincial Yachting Assoc to classify the various and rapidly growing yachting fleet in Auckland by designating the various types of keel boats and center boarders with a letter and a number. "As with all great ideas it worked until vested interests bent the rules. In the case of "Mawhiti" and her sister ships it was assumed that they would be classed with the other 18ft center boarders as a V class, but the RNZYS decided that their new restricted centerboard class was too valuable to be lumped in with the "working man's" V class 18 footers, and "persuaded" the APYA to allocate the letter M to their new fledgling class, probably based on the fact that the first two had names starting with M. "The authority on the M class or "Emmy" as it was colloquially known is Robin Elliot whose book Emmy is a fascinating study of the class. Robin and I go back to the 60's when I was a junior customs clerk in the Customs department in Auckland and Robin was a customs agent clerk. We had a mutual interest in yachting and history which has remained until today. "Now back to the M Class photo's. The Header page is "Mach One", M46, which was the first of five boats built by Owen Reid to his own modification of the Laurie Davidson designs which had dominated the class from the 1960's onwards. The Reid boats are very fast down wind and are unique in that the plank lands are glued despite being made of solid Kauri in normal clinker fashion. All the planks were saturated with Everdure to stabilise them. "Mach One" weighed 421kg when launched when the average was closer to 500 kgs so a minimum weight limit of 450kg hull and center board is now in place. The second photo, "Menace" is M48 and the last of the Reid boats to be launched, she is one of the best now and fitted out just like a normal top line racing yacht. As you can see they have a four person crew; yes, there are a few girls crewing but they are powerful boats needing a bit of muscle in windy conditions. They have been based for years at the Royal Akarana YC in Okahu Bay in the inner east of Auckland's Waitemata Harbour and currently have about 8 to 10 active boats. "The Mullet Boats are not connected in any way with the M's . Their origins are from the fishing smacks that fished in the shallow bays and estuary's of the Waitemata harbour, an inner Hauraki gulf where mullet abounded. They were identified by length of hull ( but not overall as they carried bowsprits and overhanging booms) in 20, 22, 24, 26 and 28 footers. They were sailed by a crew of two and were fast and weatherly half decked boats, that once they had caught their quota (around a ton or 40 dozen fish) they headed back to the Auckland wharfs to sell their catch (no refrigeration) in the best possible condition. They were a straight stemmed shallow draft craft with a broad vertical tuck, barn door rudder with a large rig two headsails set off a long bowsprit and a larger gaff mainsail. Built single skinned carvel with steamed frames from the 1890's with half decks and a small cuddy aft of the mast. Powerful boats that could, in suitable conditions, out sail many longer keelboats of the day. "In the 1900's as fishing stocks declined they became popular as racing craft for the working class based around the inner western Ponsonby Cruising Club which still sponsors them today. They were known by their letter designation "H", 26ft's only a couple are around today, "I", 24ft's which were never that popular. "L" 22ft's the most famous of them which still race with modern rigs, and "N" 20ft which were only a few and you can see one on the Waitemata Woodies website.

I'm surprised that you have not mentioned the V class mulleties. Or are they not a "proper" Mullet boat. I started my serious sailing on one of those, a George Honour gaffer called "Sun". At the time she was all we could afford, but since then has become a "historical treasure". John Welsford

Post a Comment

Blog Archive

- ► April (1)

- ► March (2)

- ► July (1)

- ► February (2)

- ► January (1)

- ► December (2)

- ► November (3)

- ► October (6)

- ► September (4)

- ► August (8)

- ► July (6)

- ► March (1)

- ► February (3)

- ► January (4)

- ► December (5)

- ► November (6)

- ► September (5)

- ► August (1)

- ► July (4)

- ► June (4)

- ► May (6)

- ► April (9)

- ► March (6)

- ► February (9)

- ► January (9)

- ► December (8)

- ► November (9)

- ► October (9)

- ► August (2)

- ► June (1)

- ► May (1)

- ► April (2)

- ► March (3)

- ► February (7)

- ► November (7)

- ► September (6)

- ► August (7)

- ► June (3)

- ► April (7)

- ► March (8)

- ► January (7)

- ► December (7)

- ► October (8)

- ► August (5)

- ► July (9)

- ► June (6)

- ► May (8)

- Boating Cayuga Lake

- Music Whenever: "You Ain't Going Nowhere" Nitty Gr...

- Header Photo: The El Toro dinghy

- "Kid Simple": A Design Cartoon for a Junior Mess-A...

- Classic Moth Sail Measurement Drawing

- ► March (9)

- ► February (8)

- ► January (14)

- ► December (11)

- ► November (13)

- ► October (17)

- ► September (11)

- ► August (13)

- ► July (13)

- ► June (8)

- ► April (5)

- ► March (10)

- ► February (11)

- ► January (13)

- ► October (10)

- ► September (17)

- ► July (10)

- ► June (2)

- ► May (7)

- ► March (13)

- ► January (5)

- ► September (8)

- ► June (12)

- ► February (1)

- ► January (3)

- ► December (6)

- ► September (1)

- ► August (6)

- ► June (5)

- ► May (3)

- ► February (10)

- ► December (19)

- ► November (14)

- ► October (12)

- ► September (9)

- ► August (20)

- ► July (15)

- ► May (14)

- ► April (10)

- ► March (11)

- ► February (6)

- ► January (19)

- ► December (10)

- ► November (22)

- ► June (14)

- ► May (11)

- ► April (15)

- ► January (11)

- ► December (13)

- ► November (18)

- ► October (19)

- ► September (19)

- ► August (17)

- ► July (20)

- ► June (16)

- ► May (26)

- ► April (18)

- ► March (12)

- ► February (18)

- ► January (24)

- ► December (34)

- ► November (15)

- 10 foot skiff (6)

- 2014 IC Worlds (8)

- Academy Dinghy (1)

- Adverts (1)

- Americana (64)

- Americas Cup (14)

- Annapolis (43)

- Antipodean Sailing (64)

- Australian Historical Skiffs (48)

- Big Guy Singlehander (15)

- Blasting (44)

- Blogger (18)

- Blogmeister (54)

- Boat Blunderer (3)

- Boat Maintenance (4)

- Boat Show (26)

- Boatbuilding (94)

- Boatyard (2)

- Canadian Sailing History (3)

- Caribbean Classes (6)

- catamarans (26)

- Classic Moth (216)

- Classic Sailboats (57)

- Coaching (3)

- College Sailing (4)

- Commentary (2)

- Comments (1)

- Crash Boat (8)

- Cruising Boats (2)

- Design Cartoon (3)

- Dinghy History (28)

- Directors Cut (33)

- Disabled Sailing (5)

- Dodging the Bullet (3)

- Dutch Sailboats (14)

- Dylan Winter (9)

- Electric Boats (1)

- Elizabeth City (31)

- Europe Dinghy (9)

- European history (11)

- Family Vacations (2)

- Flat Bottom Skiff (5)

- Fleet Building (3)

- Foilers (12)

- For sale (3)

- Frankenboat (11)

- French Offshore (10)

- Gentleman Reggae (1)

- Header Photo (145)

- Historical Sketches (8)

- Ice boat (4)

- Intercollegiate Sailing (8)

- International 14 (33)

- International Canoe (35)

- John Z Mistral (9)

- Jules Verne (1)

- Keelers (46)

- Kiteboards (1)

- knockdown (3)

- Melges 24 (1)

- Micro Dinghy (16)

- Midwinters (19)

- Music for Fridays (214)

- Music Index (3)

- Nedslocker (11)

- No Excuse to Lose (2)

- No Rudder (7)

- Oh Sh#%t (52)

- Olympic Classes (37)

- Other sailing dinghies (211)

- Other Sailing Disciplines (8)

- Other singlehanders (106)

- Paddling (1)

- Parents and Kids (13)

- Piece of Furniture (3)

- Plankers (37)

- Potpourri (3)

- Quadcopter (7)

- Race Committee (25)

- Regatta Party (2)

- River sailing (17)

- Sailboat Design (12)

- Sailgroove (2)

- Sailing Adventure (20)

- Sailing Ambassadors (1)

- Sailing Art (1)

- Sailing Canoes (59)

- Sailing Personalities (29)

- Sailing Tactics (2)

- Sailing Technique (10)

- Sailing videos (2)

- Sailing Zen (12)

- Sailmaking (5)

- Sea Snark (9)

- Sea Stories (21)

- Severn Sailing Association (5)

- Small Boat History (18)

- Small Boats (2)

- Sugar Island (7)

- Team Racing (3)

- Technology (11)

- Tillerman (33)

- Tinkerer (1)

- Traditional Sailing Craft (87)

- U.S. Sailing History (73)

- Valentine (8)

- Vamos USA (3)

- Vendee Globe 2008-9 (19)

- vintage (8)

- Vintage dinghies (107)

- Vintage Yachting (7)

- VOR 2008-9 (8)

- VOR 2011-12 (1)

- VOR 2017-18 (1)

- West River SC (4)

- Windsurfer (4)

- Wooden Boat (25)

- Y Flyer (2)

My Blog List

- CLASSIFIEDS

- NEWSLETTERS

- SUBMIT NEWS

The M Class Reinvented

Related Articles

Upcoming Events

M-Class 100th Anniversary Celebration

Join past and present, young and old to celebrate 100 Years of the M-Class at a special cocktail function.

Tickets to the Event must be purchased in advance, either from RAYC reception (in the Hyundai Marine Sports Centre) or online by adding to your cart below.

Trophies, Memorabilia and Images will be on display in the event, so if you have anything special you would like included – please email [email protected]

100th Anniversary RUGBY JERSEYS! UPDATE: One more run being ordered end of day Monday 13th March … place your order now!!

Share This Event

- This event has passed.

- « 83rd Arch Logan Memorial Regatta

- Round the Bays – Tamaki Drive Closed »

- Book a table

- Enquire now

- New Navigators Programme

- Our Sponsors

- Jobs at Akarana

- 8-10 Tamaki Drive, Okahu Bay, Auckland 1071

- Email: [email protected]

© Copyright 2023 Akarana Marine Sports Charitable Trust

This website may not work correctly because your browser is out of date. Please update your browser .

Class Associations

Click here for Back Issues

There are a wide range of different class associations in New Zealand that reflect the depth and breadth of sailing in this country.

Below you will find a list of affiliated class associations and how to get in touch with them.

Boardsailing

- NZ Kite Racing Association Inc

- Windfoil New Zealand

- Wingfoil New Zealand Inc

Double Handed Dinghy

- 29er Class Association of NZ

- 49er Association of NZ

- International 470 Class Association of NZ Inc

- J14 Class Association

- Javelin Class Owners Association

- New Zealand 420 Class Association Inc

- New Zealand Cherub Owners Association

- New Zealand Open Team Racing Association

- New Zealand Team Sailing Association

- NZ Int Flying Dutchman Association

- NZ R Class Squadron

- NZ RS Feva Association Incorporated

- NZ Sunburst Association

- The International Nacra 17 Class Association of NZ Inc

- Classic Yacht Association of NZ Inc

- Farr 1020 Owners Association

- Flying Fifteen New Zealand Incorporated Association

- H28 Yacht Owners Association Inc

- Marauder 8.4 Owners Association

- MRX Yachting Ltd

- NZ 18 Foot Skiff Association

- NZ Int Etchells Class Assn

- Reactor Yachting Association Inc

- Stewart 34 Owners Association

- Townson 32 Owners Association

- Young 88 Owners Association of NZ Inc

- NZ A-Class Catamaran Association

- NZ Hobie Class

- NZ Int Tornado Association

- NZ Paper Tiger Owners Association

- Weta Sailing Association

Radio Yacht

- New Zealand Radio Yachting Association

Single Handed Dinghy

- 3.7 Owners Association

- Europe Dinghy Class NZ

- New Zealand Hansa Class Association

- New Zealand O'pen Skiff Association

- NZ Finn Association

- NZ INT Optimist Dinghy Association

- NZ Laser Association

- NZ OK Dinghy Association

- P Class New Zealand

- Starling Class Association New Zealand

- The International Moth Class Association of NZL

- WASZP Association of New Zealand Incorporated

- Zephyr Owners Association

Trailer Yacht

- Elliott 5.9 Class Association

- Hartley 16 Class Association of New Zealand

- Magic 25 Class Association

- Noelex 22 Trailer Yacht Association

- Noelex 25 Trailer Yacht Owners Association

- Ross 780 Association

IMAGES

VIDEO

COMMENTS

M-Class Yachts. 586 likes. The Emmy as it is affectionately known is one of the classes of unballasted centreboard dinghies

M-Class. The 18-foot kauri-clinker M-Class, first formed in 1922 following designs by Arch Logan and adopted by the Royal New Zealand Yacht Squadron. The Emmy, as the M-Class Yacht is affectionately known, is one of the few traditional racing yacht classes that has survived the relentless march of progress. It is testimony to the quality of the ...

The M Class association with the support of Hyundai Motors New Zealand and the Royal Akarana Yacht Club are proud to announce the celebrations for the 90th anniversary of M-Class yacht racing. The 2012/13 season will mark 90 uninterrupted seasons of racing on Auckland's Waitemata Harbour for the iconic M-Class, affectionately known as the 'Emmy'.

This is the M Class reinvented. The boats will have a comfortable interior suitable for the racing, short-cruising and casual-sailing options, and of course for delivery passage-making. For the key use of racing, we can explore some known good racing locations, and speculate on others as well. We can go from there to noting which areas might ...

PRIVACY POLICY. m-boat

While the M-Class actually came into existence with the dawn of the Universal Rule in 1903, the class really gained its fame in the late 1920s. At that time, a group of members of the New York Yacht Club were looking about for some suitable replacement for their aging and outmoded NYYC 50 (waterline) class, and someone hit on the idea of Class ...

The M Class association with the support of Hyundai Motors New Zealand and the Royal Akarana Yacht Club are proud to announce the celebrations for the 90th anniversary of M-Class yacht racing. The 2012/13 season will mark 90 uninterrupted seasons of racing on Auckland's Waitemata Harbour for the iconic M-Class, affectionately known as the 'Emmy'. The season's first regatta is set for ...

Auckland NZ Office +64 9 413 9465 View All Sales Locations View All Service Locations. Classic Series ; X Class; M Class; S Class; Outer Reef M Class. As the owner of an Outer Reef, you will rest assured your yacht is built to the highest standards possible, ensuring safety, fun and peace of mind. ... The yacht's beam dimension - Yachts within ...

Two new M-Class yachts launched in style at Royal Akarana. by Suellen Hurling on 9 Dec 2011. The 18' M-Class, affectionately known as the 'Emmy', was first launched back in 1922, some 89 years ago. The classic clinker, which as per the class rules must be built in kauri, are better described as a piece of furniture rather than competitive ...

The previous header photo was of the New Zealand classic M Class, a restricted lapstrake design originally by Arch Logan from the 1920's. Below is another M going upwind. ... The yachts concerned are M class which is a restricted center board class that sprang from a design by Arch Logan in 1922 for a prominent Auckland family for their two ...

A modern M-boat will be a true racing boat, capable of the same kind of performance that one expects from a J-Class or 12-Metre: a powerful boat, but also very seaworthy if properly equipped. For cruising, the boat's large fore triangle and 80% rig allows a good distribution of sail between main and fore triangle, making it easy to balance.

AUCKLAND NEW ZEALAND February, 2001. Great sailing by M Class yachts on Lake Pupuke on Aucklands North Shore on this date. Logan Design goes back to 1922.

It's an M-boat, about 20% larger than a 12-Metre, considerably more powerful, and a true racing yacht capable of housing a nice interior as well. The modern M-boat is a true racing boat, capable of the same kind of performance that one expects from a J-Class or 12-Metre: a powerful boat, very seaworthy if properly equipped.

March 4, 2023 @ 6:00 pm - 11:30 pm. You're Invited to join the official M-Class 100th Anniversary Celebration! Join past and present, young and old to celebrate 100 Years of the M-Class at a special cocktail function. Tickets to the Event must be purchased in advance, either from RAYC reception (in the Hyundai Marine Sports Centre) or online ...

Find Power Motor Yachts for sale in New Zealand. Offering the best selection of boats to choose from.

H28 Yacht Owners Association Inc. Marauder 8.4 Owners Association. MRX Yachting Ltd. NZ 18 Foot Skiff Association. NZ Int Etchells Class Assn. Reactor Yachting Association Inc. Stewart 34 Owners Association. Townson 32 Owners Association. Young 88 Owners Association of NZ Inc.

M class yachts competing in the Logan Memorial Trophy race, 1980, Auckland. Five yachts visible in image with more hidden in the background. On the far left is MARQUITA (M44) and in the centre MAHINA (M4). Article: Sea Spray Jun 1980 p. 30.

New and used Yachts boat for sale in New Zealand on Marine Hub, find the right boat for you at NZ's leading marine advertising portal. Login. Register; Home; Listings; Selling; Directory; Accessories; Marinas; ... Alan Wright Yacht incl trailer. $16,900 Townson Pied Piper. $19,000 Davidson 28. $19,000 1978 Nova 28 Bilge Keeler. $19,000 Davidson ...

A DIFFERENT KIND OF SAILING EXPERIENCE by Dave Fladlien. There are two things about Pursuit which set sailing the boat very much apart from sailing other medium or medium/large boats. The most apparent is that Pursuit is a strictly traditional boat: no modern sail-handling equipment at all. That we definitely intend to change in a modern M-Class.

Motorized yachts are more common than sailing boats in New Zealand with 80 powerboats listed for sale right now, versus 53 listings for sailboats. Yacht prices in New Zealand Prices for yachts in New Zealand start at $72,256 for the lowest priced boats, up to $10,220,210 for the most luxurious, opulent superyachts and megayachts, with an ...

The drawings in this section are working drawings for the "demonstration" boat of the Fladlien & Associates M-Class design development program. They show what a modern M-boat actually might be like. They are not just conceptual drawings. The arrangement plans shown are only a sample of a large number of possibilities.

Date: Nov 2018 From: Boating New Zealand, By: Kidd, Harold Description: Continues to look at indigenous unballasted Kiwi centreboard yachts, discussing yacht racing in standard classes. Looks at how the X class was developed after World War One and spread quickly as a racing yacht with the establishment of the Sanders Cup and patronage by Lord Jellicoe, only to become a professional racer ...

class M. Windward. Pursuit. Sirius II. universal rule of measurement. traditional yacht. classic yacht ... This page is meant to redirect the reader to designers' sites which showcase various ideas about modern M-Boat design, including possible hull forms, keel or rudder designs, rigs, sail plans, interior arrangements and deck layouts, or ...