Are Sales And Use Taxes Avoidable On Your Boat?

- By Raleigh P. Watson

- Updated: May 6, 2019

One of the most common questions maritime lawyers receive from potential clients is how to avoid sales tax on a boat. Unfortunately, every jurisdiction has different regulations, and they are always subject to change. Oftentimes, there is no reasonable way to avoid paying tax on a boat, especially if you plan to purchase and use a boat in one specific state that does have a sales tax. Nevertheless, there are circumstances in which legally avoiding sales and use taxes is a real possibility.

Sales Tax Versus Use Tax for Boats

Sales and use taxes on vessels are imposed at the state and local levels. Sales tax is imposed at the time of purchase or transfer; use tax is imposed at the same rate as a state’s sales tax, but it is imposed on boats not taxed at the time of purchase. It can be paid at the time of registration in a state other than where a boat was purchased, or it can be triggered by the use or storage of a boat for a certain amount of time in a given jurisdiction. Each state has its own rules as to how long a boat registered elsewhere can be within its jurisdiction before triggering use tax liability.

How to Avoid Sales Tax on a Boat

There are several options as to how a buyer can avoid sales tax. Of course, the simplest method is to purchase a boat in a nontaxing state, such as Delaware or Rhode Island. But let’s be honest, understanding boat taxes by state is a lot to ask for when buying a boat. Although it may be helpful knowledge if the buyer also plans to store and use the boat in that state.

In some jurisdictions, there might be an escape or removal clause in a state’s statutes. These clauses often require the buyer to submit a removal affidavit: The nonresident buyer must certify the boat will be leaving the state within a certain amount of time. A buyer can also be required to submit proof of departure (fuel or dockage receipts) and registration in another jurisdiction; they can also be prohibited from taking the boat back for a certain amount of time. The process is relatively straightforward, but it is imperative the guidelines are followed. A state’s taxing authority will have little sympathy for those who fail to follow its rules.

An offshore closing is another option for buyers who wish to avoid sales tax, especially when dealing with boats of considerable value or for owners who plan to travel constantly or register the boat in a foreign location. This type of transaction is a bit more complex and requires the parties to close offshore, outside the state’s waters. If practical, we often recommend an offshore closing over a removal affidavit because it eliminates the need for paperwork to be submitted and keeps the buyer off the state’s radar.

Additional Helpful tips

Avoiding sales tax where a boat is purchased is simply the first step in the process. Some states have an annual property tax on boats, which can be more expensive than sales and use taxes over an extended period of time. Additionally, use tax can be a complex and perpetual battle for those boats that spend time in multiple jurisdictions where it is not tax-paid. Buyers should be aware that most states require the applicable tax payment at the time of registration. Thus, a buyer can avoid tax at the time of purchase, but tax will still be owed if the boat is ultimately registered in a taxing jurisdiction.

The good news is most taxing authorities will provide a credit for sales tax paid to other states so long as the owner can provide proof of payment for the vessel in the form of a receipt or closing statement signed by a dealer or broker.

This is an elementary overview when it comes to sales and use taxes of boats, and there are many presumptions, exceptions, clauses and penalties that this article simply cannot cover. We routinely advise clients on how best to handle the taxes associated with their boat, and sometimes attempting to avoid sales and use taxes simply isn’t practical. In other situations, avoiding sales and use taxes is not only possible, it can save an owner a significant amount of money. Regardless, every boat buyer should be educated on the relevant rules and regulations.

- More: Boat Ownership , legal , Sport Fishing Boats

Free Email Newsletters

Sign up for free Marlin Group emails to receive expert big-game content along with key tournament updates and to get advanced notice of new expeditions as they’re introduced.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By signing up you agree to receive communications from Marlin and select partners in accordance with our Privacy Policy . You may opt out of email messages/withdraw consent at any time.

Merritt 88 Skybridge Review

Updates to the right whale speed restriction rule, jarrett bay boatworks 64 review, all in a day’s work, record-breaking payout for blue marlin in the 2023 midatlantic tournament, gulf coast grander to wrap up the 2023 season.

- Digital Edition

- Customer Service

- Privacy Policy

- Terms of Use

- Email Newsletters

- Tournaments

- Expeditions

Many products featured on this site were editorially chosen. Marlin may receive financial compensation for products purchased through this site.

Copyright © 2024 Marlin. A Bonnier LLC Company . All rights reserved. Reproduction in whole or in part without permission is prohibited.

Sign up for free Marlin Group emails to receive expert big-game content along with key tournament updates and to get advanced notice of new expeditions as they’re introduced.

Subscribe to Marlin

Subscribe now to get seven keepsake print editions of Marlin per year, along with instant access to a digital archive of past issues, all for only $29 per year.

- Bermuda Triple Crown

- Los Cabos Billfish Tournament

- Offshore World Championship

- Scrub Island Billfish Series

- Casa Vieja Lodge Ladies Only

- Casa Vieja Lodge

- Ballantynes Cove

- Newsletters

Answers in Boat Tax Law

Maryland and us boat tax attorneys.

How to avoid paying taxes on your boat…legally!

Eds. Note: This article originally appeared in the Waterway Guide as a feature for cruisers. http://www.waterwayguide.com/resources.php . Updated to reflect Maryland’s cap – more here .

Dirk Schwenk, Esq., is a real estate and maritime attorney located in Annapolis, Maryland. If you are interested in his non-tax practice, please see Baylaw, LLC . For issues specific to waterfront property, please see Waterfrontlaw .

In my last article, I wrote about Maryland, specifically Maryland’s boat tax, and while Maryland and the Chesapeake are fantastic cruising grounds, I do recognize that there are other states in the Union. Since many of you readers and many of my clients venture out in the world-visiting far flung locales from Maine to Florida, the Caribbean and far beyond-I am often asked about the tax implications of other jurisdictions. I take these inquiries to mean:

How can I legally avoid paying taxes on my boat?

There is of course no simple answer to the question. If there were, the tax authorities would close it. That’s what happened in the good old days when it was pretty safe to register a boat to Delaware, place it in Coast Guard documentation, and call it good.

After reading this, many folks will just want to buy their boat, pay the tax, and go cruising, and that’s great. Many boat taxes support boating related activities and needed facilities. Others purchasers, however, plan to leave the country, or keep the boat moving for a long time, and perhaps have a higher threshold for risk. Paying sales tax may not be desirable or necessary, and they may be willing to do what is necessary to organize their boating life in a way that is not subject to tax.

This article is the first step, and the easiest step in that direction.

Before we get into specifics, however, let’s go back to the beginning. What kind of tax are we talking about and who collects it? There is no federal vessel tax (and may the federal luxury tax stay good and dead!), so taxes are imposed at the state and local levels. Generally, there are three taxes of concern to boat owners: sales tax, use or registration tax, and personal property tax. Sales tax is imposed, if at all, at the time of purchase. Use tax is imposed by sales tax states on goods that were not taxed at the time of purchase. Personal property tax is an annual tax, payable every year, on property that is kept within a jurisdiction. This article will focus on sales tax.

It is hard to keep track of all of the state taxes, and nearly impossible to keep track of all of the county and municipal taxes. Not only are they all different, but they also all subject to change. BOAT/US provides a good general comparison of state taxes on its website www.boatus.com/gov/state_boat.asp but I understand that it is being updated now after several years without revision.

Below is a table that gives the bare-bones of the state taxes in the East Coast cruising grounds as they exist at the moment (revised 2016). It does not include many defenses, exceptions, exclusions, penalties, interest on late payments, and any number of other important details, nor is it legal advice, but it does provide a rough snapshot of the tax on the purchase of a boat.

Mr. Schwenk provides representation in purchase, sale and tax and also buyer’s broker (selling broker) services to select clients. It is strongly recommended that you do not enter into a contract with dual agency (one broker as both listing and selling broker). If you would like buyer’s representation – please email with the heading “Baylaw Buyer’s Broker” or use this link: [email protected]

To return to the question-How can I legally avoid paying taxes on my boat-the middle column is the key. Sales tax is the tax on a purchase or transfer of a boat. If you want to avoid sales tax, the easiest option is to finalize your purchase in a jurisdiction that doesn’t tax the sale or caps the tax at a low number. This may mean driving to Delaware and choosing a boat at a Delaware dealer.

There are more sophisticated strategies as well, such as writing a contract that requires a Massachusetts boat to be purchased through a transaction that takes place New Hampshire. Or taking final possession and completing the purchase of a boat in international waters-this is where most of the big boats go. These latter items have their risks, however, particularly the fact that they make local tax authorities suspicious, even if the transaction is properly done. It does not help matters that some unscrupulous purchasers will fake an out-of-state or international transaction, and thereby paint legitimate purchases in a bad light.

Another very good option to avoid initial sales tax is to identify an escape clause in your local tax jurisdiction. In Maryland, for example, one need not pay sales tax on a boat that files a certification stating that it is going to leave the state within 30 days of purchase. Similarly, in Florida, a non-resident need not pay tax if the boat is taken to a different state shortly after purchase. If you anticipate taking your boat out of the country, using it in a state that does not have a sales tax, or actively cruising between lots of jurisdictions, avoidance of paying the initial sales tax can be a big cost savings. If nothing else, a boat can depreciate a good deal over the course of a few years.

I stated above that this article would address the first step in legally avoiding tax on a boat. Well, that was it. The first step is to legally avoid sales tax. Anyone that has been around boats, however, will recognize that this is just the beginning. Most sales tax states have two other closely related taxes, title tax and use tax. Use taxes were devised to take the profit out of going across state lines to purchase products, which is exactly the conduct we’re talking about here.

Use tax is usually imposed at the same rate as sales tax and is imposed when you bring the boat back into a state. Use tax must be of primary concern to anyone that has not paid sales tax. (If you have paid sales tax to a state however, you can rest easy, as sales tax is an offset to use tax). For Marylanders, use tax is the tax that a buyer will face on the boat purchased in Delaware and brought home on a trailer.

Future installments of this Waterway Law column will address use tax and personal property tax. These taxes are more complicated in their application than sales tax and take much more sophistication to legally avoid. Use tax is triggered by the use of the vessel and is subject to lots of argument about how much time triggers the tax as well as exceptions and defenses. Personal property tax is often collected by local counties or cities, and so it can be widely different even within a single state. There are no simple answers here.

In the meantime, if you are buying or have purchased a boat for a significant amount of money, you should seek specific legal advice about how to conduct your affairs. Avoiding sales tax is only the first step, but if done improperly, can bring far worse consequences such as penalties, interest, liens, etc. A good lawyer can provide advice about how to maintain your boat in a situation in which it does not owe tax, and if you follow that advice, you can save a significant amount of money.

Happy cruising!

- Boat Reviews

- Press Releases

Sales Tax on a Boat: Can You Avoid it?

Trying to navigate what the best options are, as they relate to taxes and registering your new yacht can be a difficult feat if you are new to boating. Uncle Sam's rules vary state by state and we are here to shed a little light.

This article is designed to provide prospective yacht owners with an overview of state sales tax. It should not be considered guidance. As in all things that are related to taxes, we recommended that you consult a tax professional for advice.

Registering by state

Regarding the US, the state you keep your boat in is the state that is going to want their sales tax. It can also be called a use tax, taking into consideration you are using the waters of that state. It does not matter where you are documented or registered, it is where your boat resides. Since July of 2010, Florida caps sales tax on a vessel at $18,000. Meaning, no matter the purchase price of the yacht, you will not pay more than $18,000 in taxes. If you are planning to keep your boat in Florida, for that kind of money, it simply doesn't make sense to register your boat offshore. In New York, you would pay taxes on the first $230,000 of the boat's purchase price. North Carolina’s boat sales tax is 3% and capped at $1,500! In Maryland, the maximum out of pocket in sales tax is $15,000, while not too far away in Virginia the boat sales tax is 2% and capped at a measly $2,000.

Always a different set of rules

As mentioned before, the state in which your boat is used is where you will have to pay sales tax. If you were to purchase a boat in different state, there would be a limit on how long that boat can remain in that state before you must pay sales tax. Each state has a limit of how long you can stay before they require state sales tax payment, and each state has a different requirement. Florida is six months when you file an exemption and pay a fee at purchase, but then you cannot come back for six months. That is why it is also called a use tax rather than a state sales tax. For example, you did not buy your boat in New York, but if you stay in New York they will require you to pay their sales tax / use tax, same amount, minus any state sales tax you paid in another state.

Why do people do offshore closings?

Offshore closings are usually done to avoid Florida tax stamps on a boat mortgage. In order to achieve this you must go three miles of shore into international waters. Then you sign your loan documents in front of a loan officer. Then we will take a photo of today’s paper and the GPS coordinates. Once we've done that, the captain signs an acknowledgement of what has transpired. This will also avoid Florida sales tax because the transaction took place out of Florida waters. But remember, if you intend to keep your boat in Florida you can't get around Uncle Sam.

Foreign Flag Registry

If you are a foreign flagged yacht you will need to obtain a cruising permit and you will have to clear in and out. This is not necessary if the vessel is US flagged. If you have a foreign flagged vessel in the US, you may hire foreign staff who possess specific types of visas to work on your yacht. If it is a US flagged yacht, you may hire U.S. citizens or people with U.S. work permits only.

At the end of the day it call comes down to what your cruising plan is. Once you have established your first few months up to a year of ownership and consulted a tax professional, the decision on state registration and sales tax should be much more clear.

Topics: Boat Buying Process , FAQ

Subscribe Here!

Save clients money on taxes

Over 1,500+ tax strategies

Deduct meals provided for business purposes

Reduce taxable income & self-employment tax by hiring your kids

Claim a tax credit for your spend on business R&D expenses

Manage client requests

1040, 1120/S, 1065 & more

Plan for multiple entities

Easily gather planning inputs

52+ states and localities

Custom-branded tax plans

Request and manage documents

Read more about tax planning

Tax terms and phrases defined

Watch our educational videos

Tax deadline all in one place

Our clients say it best

Get help with our products

Your questions answered

Safeguard confidential data

How to Increase the Capacity of Your Firm Using Tax Planning Software for CPAs

Learn more about Corvee

Meet the team

Check out our press coverage

Recognition, awards and more

Get in touch with us

Join our growing team

- What is Tax Planning

- Tax Planning Strategies

- Tax Planning

- Client Collaboration

- Federal Tax Planning

- State & Local Planning

- Multi-Entity Tax Planning

- Smart Questionnaires

- Client Requests

- Corvee Blog

- State Tax Deadlines

- Case Studies

Yachts and Taxes: Everything You Need to Know

7 minute read

Those who are seeking freedom, pleasure, or adventure often dream of owning a boat. Unfortunately, the cost of boat ownership is financially draining due to expenses such as storage, registration, insurance, fuel, and maintenance. However, there is some good news for those who want to set sail.

Can You Write Off a Boat on Your Taxes?

The good news is that there are some tax write-offs available for boats used for business and even pleasure that can offset some of the expenses. And yes, this includes yachts and tax deductions.

What Taxes can You Expect When You Buy a Yacht?

The bad news is that yachts are subject to taxes. These taxes go towards waterway upkeep, on-water services, and boat facilities. Most of the taxes will be state-based, so you should find a planner who is versed in state and local planning as well. There are 4 common taxes that yacht owners have to pay.

Sales tax is paid at the time of purchase. This tax is based either on a percentage applied to a portion of the purchase price or a flat rate with a cap. Yacht owners may also be subject to a local sales tax. The sales and local tax are dependent upon the state, county, and municipality that you made the purchase.

If you don’t pay sales tax on your yacht at the time of purchase, you probably will have to pay a use tax in the state where you will be storing your boat. Use tax is applied to only a certain portion of the yacht’s purchase price. If the sales tax rate is higher in the state you purchased the yacht than the use tax in the state where the boat is being stored and used, then you will probably want to opt to pay the use tax and not the sales tax.

Personal Property Taxes

Many states levy a tax on personal property such as cars, and that could be extended to your boat! Depending on the state the yacht is based out of, you may have to pay personal property taxes on a yearly basis.

Property Taxes

There’s even a property tax on the boat slip. If you own a boat slip, the slip is assessed by the local municipality. If you are leasing a boat slip, property taxes are usually included in the monthly lease.

Easily Save Clients Thousands in Taxes

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

What is a Yacht Tax Write-Off?

While there are taxes every yacht owner has to pay, the flipside is that there are some tax deductions that can save yacht owners money on their taxes. The deductions depend on how the yacht is being used.

Business Use

There are some substantial tax deductions if you are using your yacht for a legitimate business purpose such as chartering or for sightseeing tours. To qualify for business use, the yacht must be used for business purposes at least 50% of the time.

Purchase Price Expense Deduction

Under Section 179 of the Internal Revenue Code, the Purchase Price Expense Deduction allows an entity, either a corporation, partnership, or LLC, a one-time deduction of 100% of the purchase price of the yacht, up to a maximum deduction of $500,000, during the year of purchase. However, the benefit is reduced if the purchase price is more than $2 million. The yacht can be new or pre-owned. Equipment upgrades can be written off as well if they are within the same year the yacht was purchased.

Business Expense Deductions

If you are earning income off of your yacht at least 50% of the time, then you can deduct business expenses from your taxes. Some of the business expenses that can be deducted include equipment, slip costs, fuel, maintenance, crew salaries, interest, property tax, insurance, and depreciation. Thanks to the Tax Cuts and Jobs Act, entertainment is no longer deductible.

Home Office Deduction

This deduction is frequently overlooked. If your boat is used as a part-time office, you may also qualify for the home office deduction. The activities in this yacht office must be business-related and occupants must have business discussions while aboard the yacht.

Business Commuting

If you use your boat for commuting to and from work, you also may qualify for tax deductions. Again, you must use the yacht at least 50% of the time for business transportation. The deductions for business commuting include storage, crew salaries, depreciation, repairs, fuel, and insurance.

Depreciation

As mentioned earlier, depreciation can be a tax deduction if the yacht is used in business. A bonus depreciation deduction can be taken in the year the yacht was purchased. Depreciation, in this case, is 100% of the purchase price., but this is only available until the end of 2022. Beginning in 2023, the amount of bonus depreciation will be 80% of the amount over 0,000 after section 179 . The adjusted cost basis of the yacht can be depreciated over the period of 10 years. To determine the cost basis, you deduct the Section 179 expense deduction and the bonus depreciation deduction from the purchase price. Cost basis is the balance.

What are the Tax Advantages of Living on a Boat or Yacht?

Some individuals actually live on their yachts. There are even tax advantages to using your yacht as a primary residence or as a second home.

Is Boat Loan Interest Tax Deductible?

Deducting the interest you pay on your boat loan, similar to mortgage interest, is the biggest tax deduction for recreational boating. To qualify for this deduction, the yacht must have a toilet, cooking facilities, and a sleeping area. The second home mortgage interest deduction has a cap of $750,000.

If you rent your boat out, you need to stay on the boat for either at least 14 nights during the tax year or 10% of the number of days the boat was rented to take advantage of the tax deduction as a second home.

There’s another tax advantage to living on a yacht. If your yacht is listed as your primary residence and you happen to sell it at a profit, you could qualify for a capital gains exclusion which would result in a huge savings on your taxes.

Is There any Deduction for Donating a Yacht to Charity?

If you are in a position to donate your yacht to charity, then the IRS offers a deduction for this generous act. The market value of the yacht on the day it is donated can be deducted from your taxes.

Getting the Most Out of Yacht Tax Deductions

If you are a yacht owner and are looking to save on taxes, deductions can be a powerful strategy. Good tax planners, however, use a variety of strategies each year to save money. Tools such as Corvee tax planning software help taxpayers quickly find the strategies available to them. Request a demo today.

Related Posts

Understanding the Augusta Rule and Its Tax Implications

The Fundamentals of Depreciation

FASB Accounting Rules for Crypto

- Popular Posts

- Latest Posts

Are GoFundMe Donations Tax Deductible?

Top 9 Tax Deductions and Credits …

Child and Dependent Tax Credit for …

Hobby Losses: What You Need to …

What Industries Qualify for the R&D …

Hiring Your Kids for Tax Savings

How to Use the Home Office …

Understanding the augusta rule and its ….

Take The Next Step

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Want to Learn More?

Please fill out the form below.

- Name * First Last

- Firm Size / Revenue * Firm Size/Revenue* Sole Practitioner (Less than $250K) Small Firm ($250K-$1M) Medium or Large Firm ($1M+) I do not own a firm

- Firm Specialty * Firm Specialty* Multi-Service Tax Accounting Financial Advising I do not own a firm

- Tax Planning Software

- Growth and Development Programs

- Advisor Partnership

- I agree to the privacy policy. By clicking “Submit” I agree to the Terms & Conditions and Privacy Policy and agree to receive emails and texts about promotions at the phone number and email provided, and understand this consent is not required to purchase.

- Name This field is for validation purposes and should be left unchanged.

Interested in Partnering?

Fill out the form below, and we'll be in touch.

- State * State* Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State

- Current Broker-Dealer or RIA *

- Assets Under Management *

- Partner with an Advisor

- Become an Advisor

- Phone This field is for validation purposes and should be left unchanged.

- Comments This field is for validation purposes and should be left unchanged.

Schedule Your Free Demo

- Hidden Firm Specialty * Firm Specialty* Multi-Service Tax Accounting Financial Advising I do not own a firm

- Hidden GCLID

- By clicking “Submit” I agree to the Terms & Conditions and Privacy Policy and agree to receive emails and texts about promotions at the phone number and email provided, and understand this consent is not required to purchase.

Schedule a Free Demo with Q&A

Let us show you how you could save your clients thousands of dollars and make tax planning easier than ever with Corvee.

Request a Demo 2.0 (Tax advisor or accountant)

" * " indicates required fields

By clicking the button above I confirm that I have read and agree to the Terms & Conditions and Privacy Policy and agree to receive emails and texts about promotions at the phone number and email provided, and understand this consent is not required to purchase.

Win a Free 1-Year Subscription to Corvee Tax Planning Software. To become eligible, schedule a demo before March 31.

- Frank Magazine

- Denison History

- Virtual Tours

- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Ocean Alexander Yachts

- Offshore Yachts

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

- Pershing Yachts

- Prestige Yachts

- Princess Yachts

- Pursuit Yachts

- Riva Yachts

- Riviera Yachts

- Sabre Downeast

- San Lorenzo Yachts

- Sea Ray Boats

- SeaVee Central Consoles

- Selene Trawlers

- Scout Yachts

- Sunseeker Yachts

- Tiara Yachts

- Trinity Superyachts

- Viking Yachts

- Westport Yachts

What You Need To Know About Sales Tax Assessment + Buying A Boat

A maritime lawyer breaks down a question about sales tax and buying a boat..

This article originally appears in Sea Magazine , written by David Weil.

Question: I am in the market for a motor yacht in the 50-foot range and would like some information regarding the assessment of sales tax on my purchase. My broker suggested I should form an LLC to buy the boat, since a purchase by an LLC would be tax-exempt. Is this accurate? I would be looking at a significant tax bill on this purchase, so I want to know what to expect before I make my offer.

Answer: The simple answer to our reader’s question is a resounding “NO.” An LLC is a taxpayer like anyone else, and it is not automatically exempt from the assessment of sales or use tax on the purchase of a boat. But let’s look at this in more detail.

Our reader, like many people in the market for a boat, is concerned about the assessment of sales tax or use tax on his purchase (sales tax is assessed on the purchase of a new boat from a dealer, and use tax is assessed at the same rate on a used boat). The exact assessment varies from county to county , but the rate in California is now generally close to ten percent. That will add up to a significant tax bill regardless of the purchase price, and as such the yachting community has always looked for strategies to avoid that expense.

Sales tax law varies from state to state . California will assess sales or use tax if the boat is (1) purchased in California OR (2) purchased for “use” in California. California’s territorial boundary extends three miles into the ocean, so if the purchase can be structured to close more than three miles offshore (an “Offshore Delivery”), the buyer will satisfy the first prong of the test. The second prong involves a subjective analysis of the buyer’s intended use at the time of the purchase, which is a little more complicated. A calendar test was devised, and if the boat is kept outside of California for a period of time after the purchase it may be exempt from the tax.

Many of our readers will remember the “good old days,” when a buyer could avoid the assessment of sales or use tax by keeping the boat out of state for 90 days after the purchase . That all changed in 2008 when the test was increased to one year for California residents and six months for non-residents. This led to a significant reduction in “Offshore Delivery” transactions and a need to find some other way to avoid sales tax on a boat purchase. An LLC may provide that relief, but not in the way that our reader suggested. Simply put, the LLC must already own the boat before the buyer submits his or her offer, and the offer must be for the purchase of the LLC rather than the boat.

Where a yacht is owned by a corporation or LLC, the stock of the company may be transferred without affecting the ownership of the boat itself. The stock transfer amounts to a transfer of intangible personal property, even where the sole asset of the company is the yacht, and as such, the transaction will usually be exempt from sales and use tax without the need to spend any time with the boat outside of the state.

Notwithstanding the apparent simplicity of this approach for tax purposes, a stock purchase will raise all sorts of other concerns. Most importantly, the purchase of a company will include the acquisition of all of that company’s liabilities, even where those obligations are completely unrelated to the boat, and even where the buyer has no notice of the liabilities.

Perhaps the most important risk of unrecorded or undisclosed liabilities will relate to the company’s acquisition of the boat. As noted above, just like the rest of us, a company must either pay the tax or qualify for an “offshore delivery” or other exemption. In these circumstances, the company itself is the taxpayer, and a buyer who is interested in acquiring a boat through an LLC purchase must confirm that the LLC’s tax liability was satisfied.

Other tax liabilities may be equally problematic. Corporations and LLC’s are required annually to file various forms and pay fees to the state in which they are registered. Failure to do so may subject the new owner to a charge for penalties in addition to unpaid fees. Similarly, if the company has a bank account in its name the IRS may look at whether any interest income was earned on the account.

A buyer of a boat through an LLC acquisition must also consider the language of the purchase contract. Yacht brokers are experienced with contracts used for the sale of a yacht, and the forms sponsored by the California Yacht Brokers Association are in fact very well drafted. But as noted above, the yacht itself is not being sold when the stock or membership of a company is transferred. The parties must therefore use a contract drafted specifically for the transfer of corporate stock or interest in an LLC.

A boat that is owned by a corporation or LLC may provide a strategy for avoiding sales or use tax on a boat purchase , but the “baggage” associated with such a purchase may lead to more headaches for the buyer after the purchase. This type of transaction requires competent legal advice, and with all due respect to my friends in the brokerage industry, a yacht broker is neither licensed nor qualified to guide the parties through the purchase and sale of a business entity. Contact an attorney who is experienced in this type of transaction.

David Weil is licensed to practice law in the state of California and as such, some of the information provided in this column may not be applicable in a jurisdiction outside of California. Please note also that no two legal situations are alike, and it is impossible to provide accurate legal advice without knowing all the facts of a particular situation. Therefore, the information provided in this column should not be regarded as individual legal advice, and readers should not act upon this information without seeking the opinion of an attorney in their home state. David Weil is the managing attorney at Weil & Associates ( www.weilmaritime.com) in Seal Beach. He is an adjunct professor of Admiralty Law, a member of the Maritime Law Association of the United States and is former legal counsel to the California Yacht Brokers Association. If you have a maritime law question for Weil, he can be contacted at 562-799-5508, through his website at www.weilmaritime.com, or via email at [email protected].

Latest News

NEWS | March 11, 2024

80 azimut 2018 sold by jordan preusz [senisa].

80 Azimut 2018 Sold by Jordan Preusz [SENISA] SENISA, an 80′ Azimut built in 2018, was sold by Jordan Preusz, who introduced the Buyer and represented the Seller along with Alesha Perez of OneWater Yacht Group. SENISA can accommodate up to eight guests in four staterooms, including a

NEWS | March 6, 2024

Swimming with sperm whales.

Swimming with Sperm Whales Coming eye-to-eye with Sperm Whales in their native environment will take your breath away. Words and photography Gaelin Rosenwaks. I was two years old the first time I looked into the eye of a sperm whale. He was nicknamed Physty,

NEWS | March 4, 2024

135 baglietto 1999 sold by riccardo solci [blue ice].

135 Baglietto 1999 Sold by Riccardo Solci [BLUE ICE] BLUE ICE, an 135′ Baglietto built in 1999, was sold by Riccardo Solci, who introduced the Buyer. Frank Grzeszczak with FGI Yacht Group represented the Seller. BLUE ICE underwent refits in 2016 and 2021, which included a comprehensive paint job

Captain's Tips

State tax laws for boaters.

For many of us our boats represent a sense of adventure hard to duplicate elsewhere in our lives. We purchased them with dreams of cruising to distant harbors and exploring waters far from home. Or many have purchased their boats to become their homes, freeing themselves of a permanent address. So what happens to the dream of cruising when you receive a letter from a state's tax authority stating you owe them taxes for using your boat in their waters?

All states require boats above a certain size to have some form of registration, although some may accept federal documentation in lieu of state registration. in addition to requirements for registration, many states require some sort of tax to be paid for boats purchased or used within the state.

There are three types of taxes which can be levied on boats by state and local governments; sales tax, use tax and personal property tax. Some states collect all three and some states collect none. This is further complicated by local county government's involvement in personal property taxes. Due to the potentially high cost of these taxes on expensive boats, many owners have gone to great lengths to minimize or avoid these taxes all together when purchasing their boats. as budget strapped states look for additional revenue, many have increased their patrolling of marinas looking for boats registered out of state. They are casting a wide net, looking for anyone suspect of violating their tax policy in hopes of catching the few that are. Unfortunately, a number of innocent boaters just out cruising or living aboard are being caught in that net in the process.

Because this can be such a complicated issue, we've asked an expert to contribute to this subject with us. Dirk Schwenk of Baylaw, LLC is an attorney based in Annapolis specializing in maritime law. Dirk has written extensively on boat tax policy and offers registration and tax consulting for anyone purchasing a boat.In our conversations with Dirk we learned there are two separate questions on this tax issue, one is: How to minimize or avoid paying tax on a boat when it is purchased? Which we are not addressing in this article. The other is assuming the boat was lawfully purchased and registered in a state, regardless of whether that state collects sales tax or not: How does a boater keep from paying the use tax while traveling to other states that may be attempting to collect taxes just for using the boat in that state's waters?

If our members want us to help them plan a summer cruise to New England or winter cruise to Florida, how can they know they are not going to be in violation of a state's use tax policy?

Use tax defies simple answers, because every state is different and most states treat their residents differently from the rest of the if you are truly cruising (in the sense of moving between various states every couple of months) and you do not have the boat in your state of residence (New Jersey, for example, asserts the right to tax a resident's boat on the first day it is in the state). I generally try to put my clients in a position where their boat is most often in a state that:

- 1) They like to cruise.

- 2) They are safe from tax because they either have paid some tax or because they have a definitive exemption.

- 3) If their plans change, they send me a quick email to go over their float plan. There are several states that have capped their use tax or have exceptions for boats that are not purchased there, so once established in such a location, a boat owner can feel secure that they will not be bothered. Florida can be very tax-friendly for people that are not residents, do not own real property or are otherwise not closely tied to the state.

So if I understand your answer above correctly, a boater does not necessarily have to register their boat where they live and where it is registered can affect the ease with which they can travel from state to state?

Correct. Generally a boat must register in the state in which it is used most, so the boat's location is more important than the owner's location. For some boats, it is difficult to identify the main place of use, so i generally try to have those boats initially register in a location that has a connection to the boat and then change the registration if the boat later comes to rest in a particular state. I do not recommend that a boat be in the United States with no identified state it draws too many questions. For the very large vessel, a capped state like Florida or Maryland is a good option, since the tax amounts are not that large relative to the value of the vessel and they are desirable states in which to locate and do not have personal property tax. Depending on circumstances, Florida may not require any tax.

With the approach states are using, what should our members do if they receive a letter from a state attempting to collect a tax on their boat?

First they should look at it and see whether it is an assessment of tax (the equivalent of a tax bill) or a letter of inquiry. An assessment is much more serious and typically has a very short period in which it can be appealed. if it is an assessment for a significant amount of money, they should consider hiring counsel that specializes in maritime law. A letter is somewhat less serious and if there is a simple and honest answer (such as I keep my boat in Delaware), an owner can simply respond. counsel should almost certainly be consulted if there is a significant penalty (indicating that the assessor suspects fraud); if the amount of money at issue is fairly high (say over $10,000) or out of line with the value of the boat; or if the taxability of the boat is going to be a close call, and a slip of the tongue may be the end of the defense.

For those owners that will spend significant time in the Caribbean, offshore ownership is a topic that should at least be considered in making plans for the use and tax of the vessel. Additionally, any owners with a high value boat that has not paid any sales tax, they should have a tax plan before they are contacted by tax authorities, not after.

As you can see this can be a complicated issue with costly consequences if not managed properly. For additional information on individual state's policies, you can visit Dirk's website at baylawllc.com .

Want to Stay In the Loop?

Stay up to date with the latest articles, news and all things boating with a FREE subscription to Marinalife Magazine!

Boat Taxes: Everything You Need to Know

Table of Contents

Taxes are a fact of life as well as a part of boat ownership but there may be some good news, especially in certain purchase situations and if you use your vessel as a second home or as a business. Regardless of how you buy or use your boat, brush up on the details of boat taxation to comply with federal and state laws.

Post summary:

Property tax

Boat used as a second (or primary) home deduction, boat used for business deduction, boat used for transportation deduction, boat used for charter deduction, boat donation deduction.

List your boat for rent. Earn an avg of $20K annually with Boatsetter!

When you buy a boat , you’ll most likely be paying a sales tax like you do on any other products you purchase. There are exceptions and they vary by state. You can avoid paying sales tax in the states that don’t assess sales taxes (Oregon, Delaware, and others) or if you’ll use your boat in states with a sales tax but only for short periods. Even if you bought your boat in a state without sales tax (say, Oregon) but go boating in a state with sales tax (say, Washington) you may be assessed a use tax by the state of Washington.

You may take possession of your boat via an offshore delivery which means you sign ownership papers outside of the state or its territorial waters. However, you must then keep the boat out of that state, for at minimum a year. Not all states have a provision for offshore delivery so do your research and remember that this proposition makes sense if one) you’re ready to not boat in the state where you bought the vessel or 2) if the boat is expensive enough (with a significant sales tax value) where commuting to it for a year makes sense. You may need proof of the offshore process in case you’re audited so keep good records.

As with homes, property taxes are assessed on boats. Additionally, some states require their marinas to pay taxes and they in turn pass this burden on to boat owners. You may in effect, be paying taxes on the water in your slip. There are no loopholes for boat property taxes.

A boat can qualify as a first or second home as long as it has sleeping accommodations ( berth ), a bathroom ( head ) and a kitchen ( galley ). You can take a mortgage interest deduction if your boat is financed and a home office deduction if you work from your boat. You’ll need to do itemized taxes and file IRS Form 1098.

If you use your boat to entertain clients, you can qualify for a deduction so long as “business was discussed” during the time it was used in this manner. You must keep thorough records of when, where, how long and with whom you boated and then you can deduct up to 50% of the expenses incurred during that outing including fuel, additional mooring or berthing fees, entry fees (for fishing tournaments or regattas, for example) and food/beverages.

READ MORE: Boatsetter Fishing Tournaments Sponsorship Program

Let’s say you live on an island and you use your boat to commute at least half the time for work or business. You can deduct quite a few expenses including slip fees, fuel, insurance, maintenance and repairs, and crew costs. This is an “or” use meaning that it won’t be possible to claim this deduction if you use the boat to entertain clients and use it for transportation.

If you charter your boat with a peer-to-peer (P2P) marketplace like Boatsetter, you may be able to deduct some costs of ownership but there are stipulations.

First, the costs you can claim: equipment and purchases and upgrades, slip/mooring fees, fuel, maintenance and depreciation. Now the requirements: you must show a profit at least three years out of every five and you can only deduct the percentage of the above costs that the boat was chartered. You can’t deduct all of it if you’re using the boat for your own recreation as well.

Pro tip : Keep meticulous records, you’ll be taxed on your income at a state and federal level, and you may need to upgrade to commercial boat insurance to conduct a charter business so do the math to make sure it’s worth it.

Start listing your boat for rent here

When it comes time to dispose of your boat, you can donate it to charity instead of selling it. In this case, you can deduct the “fair market value” for which you’ll need a professional appraisal and survey (which costs money). The charity must be not-for-profit. The benefits are 1) not having to find a buyer and 2) transferring the boat fairly quickly with the charity processing the paperwork and providing an IRS Form 1098-C. If the charity sells the boat, you can only claim a tax deduction equal to the sales price, not your initial appraisal.

Taxes are fluid and tax laws change not only by jurisdiction but also over time. For complex issues that may involve significant amounts of money, keep thorough records and consult your CPA or a maritime attorney because boat deductions tend to raise red flags. Once you have it figured out, you’ll be able to deal with the taxman like a champ.

About us

Boatsetter is a unique boat-sharing platform that gives everyone—whether you own a boat or you’re just renting—the chance to experience life on the water. You can list a boat , book a boat , or make money as a captain .

Rent. List. Share—Only at Boatsetter

Boatsetter empowers people to explore with confidence by showing them a world of possibility on the water. Rent a boat, list your boat, or become a Boatsetter captain today.

Browse by experience

Explore articles

Safeguard your boat, yourself with these hurricane season tips

Florida Winter Vacation Ideas for the Locals and Snowbirds

How to Avoid Spooking Fish

How to Make an Old Boat Look New

Taxes On Used Boats: Do I Need To Pay Tax On A Used Boat?

When budgeting or buying a used boat, it is essential to know if you need to pay any taxes on it at the sale or annually. In this article, we will see all the types of taxes one needs to pay while buying a “used” boat.

Generally, you will have to pay the sales tax while buying a used boat, along with the registration fee to register the boat under the new name. Most states (except a few) in the US have sales tax on a new or used vessel, which needs to be paid only once unless you lost the proof (receipt).

There are a lot of states that have varying laws about the sales tax and registration of boats, so read on for more information. Because the laws vary by state, be sure to search your own state’s laws to fully understand what you are required to pay before buying a used boat.

Types of Taxes On Used Boats

As previously mentioned, there is a sales tax to pay on a used boat in most states . If you buy a boat outside your state and move it into your state, you may be confused about where to pay the sales tax. Some states require that you pay the sales tax for the state you bought it in, and others want you to pay a tax when you bring it into their state.

For instance, if you bought a boat in Idaho, they require that you pay the sales tax there unless you qualify for an exemption. If you take the boat you bought in Idaho with you to Flordia; then they will need you to register your boat within 30 days. If you did not pay a sales tax on the boat when you bought it, they would collect it from you when you registered it with them. ( Source )

You should not have to pay a sales tax twice. If you do not provide proof of the purchase and the sales tax that has already been paid, then your state may require you to pay the sales tax with them, even if you already paid because there was no record. To be safe and avoid paying sales tax twice, make sure you have receipts and proof of purchase. ( Source )

Another tax you might have to pay is a use tax (similar to sales tax). The best way to understand this tax is through an example. If you buy a boat in Montana, where there is no sale tax law, you are not off of the hook. Once you bring the boat into your home state, you will be required to pay the use tax on it. Every state that has a sales tax also has a use tax. So, when you register the boat in Idaho, California, Flordia, and so on, you will have to pay the use tax simultaneously. ( Source )

The last payment you will need to make on your boat when you initially purchase it is to register and title it in your state. Registration is required for every state , even those without sales tax or use tax laws. This is basically the same as registering your car. The process is just adjusted for boats, so if you understand the process for a car, then it is basically the same for a boat. But, here is a simple explanation if you do not understand. ( Source )

In order for your boat to legally be allowed to be ridden on in the water, you need it registered, just like how you need your car registered in your state for you to drive it on the road. One exemption is if your boat is privately owned and you operate it on a private lake. In that case, it can only be operated on private property and not in public. ( Source )

For more specifics on how your state handles boats and tax laws around boats, search your official state website to find information on boats, taxes, and registration. Or you can call your local government official office, and they can help you by providing information such as where you can go to get tax and registration settled for your boat.

How Boat Taxes Vary By State?

Every state has its own specific laws about sales tax, how much it is, how it applies, etc., and they all organize sales tax differently. It can apply to almost every product or apply to a list of products. Each state has its government and local government that determine some of these things regarding taxes, so how does each state handle it?

Most states operate using the same outline for their sales tax and use tax laws. The percents change per state, but overall the laws mean the same thing. So by understanding the first section, you will be able to understand how those laws pertain to each state.

Boat taxes, like sales tax and use tax, vary by state, firstly through the price. Some states have a higher sales tax than others, so depending on where you live, where you buy a boat, or where you register a boat, the prices can change.

For example, sales tax in California is 7.25%, in Arizona , it’s 5.6%, and in New York , it is 4.5%. You can look up the sales tax of your state if you do not know it already, and you can use that information to find out how much sales tax you will have to pay on your boat.

Another thing that might be different between states is when they need the sales tax by. For instance, some states want it when you first buy the used boat, but others need it within a certain time period. This can be for many reasons—if you buy through a private seller, and you pay the sales tax when you register the boat, then that is when they will need that by.

Others will want you to go into the office immediately after purchasing the boat to turn in papers and pay the tax. Other times, you pay the tax right at signing. So, look at your state’s online information or call a local office that will help give you some information that applies to your situation specifically.

What States Don’t Require Tax On Used Boats?

States that do not require tax on used boats are Alaska , Delaware , Montana , New Hampshire, and Oregon . These states do not have any sales tax or use tax laws, so you will not be required to pay sales tax to these states when you buy a used boat.

And, if you buy a boat in another state and move it to one of these 5 states, then you can potentially do not need to pay a sales tax unless that specific state requires it. Even though these states don’t have a sales tax, you will still be required to register the boat. You will pay the registration fee, but that should be about all the fees you pay in these 5 states.

It is undoubtedly less expensive to buy a boat in these states than in other states because there is no tax. So you simply have to budget in the fact that there will be those added fees when buying a used or new boat. That way, when you have to pay the sales tax and the registration, you are prepared to pay it, and it doesn’t come out of the blue.

Specific States Tax Laws

Alabama has specific tax laws regarding the purchase of a boat. Depending on the boat you buy or what your boat comes with, you will pay a 2% or 4% sales tax. For instance, a boat trailer sold alone is taxable at 2%. If you buy a sailboat alone, it can be taxed up to 4%. So, check to see what the specific sales tax would be on a used boat in Alabama. ( Source )

Arizona has similar laws about sales tax as read above. If you buy a boat outside AZ and the sales tax is less or none compared to the AZ sales tax, you will have to pay the use tax at the time of the boat’s registration. ( Source )

In Arkansas , sales tax is collected by the seller on both used and new boats. Some fees include a replacement registration for $1 and a variety of fees depending on the size of the boat .

- A boat less than 16 feet long has a $7.50 fee.

- A boat that is 16 feet long to under 26 ft has a $15.00 fee.

- A boat that is 26 feet long to under 40 ft has a $51.00 fee.

- A boat that is 40 feet long and over has a $105.00 fee. ( Source )

Colorado has specific laws about the registration of a boat when it is bought in-state or out of state. If you bought a boat from another state, you may keep using the boat for up to 60 days with the registration as long as it is current and not expired. But, you will need your own registration after. ( Source )

Connecticut has information on how to calculate its sales tax so that you know what to pay. If you buy a boat before July, you will pay a 6.35% sales tax, and if you buy a boat after, it will be a 2.99% sales tax. ( Source )

Hawaii does not have a sales tax on boats. Boats must be registered in order to be legally used in the ocean. ( Source )

In Illinois , you will need to pay a sales tax based on two comparing prices. One is the simple sales tax which is 6.25%, or you will pay a tax passed on the vessel’s market value. Illinois will take the higher price as the tax. If you purchase from a dealer, they will be the ones submitting forms to the state for you; otherwise, you will have to arrange to pay a sales tax with the state yourself if you buy through a private seller. ( Source )

Indiana has a tax on boats if you operate or store your boat on Indiana waters. Depending on the boat’s classification, you will pay an annual tax ranging from $2.00 to $500. The excise tax is a flat $12, but be aware of these unknown costs before purchasing a boat so you can see all of the finances around getting a boat and know what the best decisions would be. ( Source )

Kansas requires that you pay a sales tax before registering a boat. If you are buying from a private seller, then have proof of sale or purchase with you, and they will take that price and calculate the sales tax for you. ( Source )

In Kentucky , to register a boat, you will pay a simple fee based on the classification of the boat. The prices range from $10 to $65 based on the size of the boat and depending on if it is motorized or not. ( Source )

Louisiana has a sales tax of 4.45% on boats until the year 2025. You will be required to fill out a form to register your boat, but there is no fee to obtain or turn in that form. On their website, they answer a lot of questions you may have. ( Source )

Massachusetts has a form you will fill out in order for them to charge you with a sales tax fee or for you to inform them that you already paid the sales tax fee. Before going into the office and bringing forms, it might be good to call ahead and ensure you have everything you need to pay the sales tax and register the boat. ( Source )

Mississippi also has classifications based on the size that determines the fee for registration. To register the boat, fill out a form specified on their site, a sales receipt, a bill of sale, and a statement on how you obtained the vessel. Not everyone needs a statement—it is for specific cases. ( Source )

My name is Mahidhar, and I am passionate about boating. Every day I learn some new things about boats and share them here on the site.

Recent Posts

How Much Does a Houseboat cost? 14 Examples (Various models)

Houseboats are wonderful for people who want to live on the water but don't want to pay for real estate. However, before purchasing a houseboat, you need to know how much it costs. On average,...

How Much Does a Bass Boat Cost? 15 Examples (Details included)

Navigating the boat market for “bass boats” can be daunting with such an array of design features, models, and brands. Bass boats are perfect for fishing. However, before purchasing a bass boat,...

- Forums New posts Unanswered threads Register Top Posts Email

- What's new New posts New Posts (legacy) Latest activity New media

- Media New media New comments

- Boat Info Downloads Weekly Quiz Topic FAQ 10000boatnames.com

- Classifieds Sell Your Boat Used Gear for Sale

- Parts General Marine Parts Hunter Beneteau Catalina MacGregor Oday

- Help Terms of Use Monday Mail Subscribe Monday Mail Unsubscribe

Boat Sales Tax

- Thread starter Levin

- Start date Sep 20, 2006

- Forums for All Owners

- Ask All Sailors

Hello everyone... So I have a question about boat sales tax and hope that someone here might have been through this difficulty before. Last year I purchased a 2000 Hunter 340 in San Diego CA for $81,000. At the time I did not pay any sales tax but I did get my boat registered with the USCG. When I asked my broker about sales tax he told me not to worry about it, that I would get a bill sometime later and that it would take 9-10 months for them to get around to figuring out all the numbers. Well here it is over a year later and I finally get a bill (while I'm in Iraq on deployment mind you) for $8,000... which seems a bit high even for California sales tax. This also includes a "late fee" of $711.00, although as this is the first bill I have gotten I don't see how I could be late, but somehow I am being charged this anyway. My questions are these: 1) Is the approximate number of $7,300 about right for sales tax on a $81,000 boat purchased in CA? (I realize that the late fee brings it up to $8,000 but without that is this about right?) 2) Do I have to pay sales tax to CA if I am not a resident there? I purchased the boat in CA but as I'm military I was wondering if there is a special clause that exempts me from sales tax... or do I have to pay the sales tax simply because it was purchased there regardless of where I'm considered a resident? 3) How do I fight the late fee, if this is the first notice I've gotten? 4) Does CA have some sort of yearly fee I must pay them, such as a registration fee on a car, and can I avoid this by registering in my home state of Tennessee? Thanks for all your help.. -Levin

I would ask your accountant for his advise. Just because the government bureaucracy decides you owe a bill doesn't make it right. As I understand it, you would owe the sales tax to the state you reside in not where you purchased it. Another thought, what jurisdiction does the state of California have over the resident of a different state?

When I purchased my boat last november, I had the boat documented and did not pay sales tax at that time. However I still had to register the boat with the DMV here in NY and that is where I paid the sales tax....it was about 3 months later that all the paper work came back from the documentation. Ask your accountant to be sure! Good luck

registering your boat in Delaware Check out registering your boat in Delaware. A lot of boaters do

Contact your Staff Judge Advocate for These answers. That is why they are there. When you are on active duty the judge advocate provides legal counsel for questions of this nature.

I Think Your Stuck With It Boats are required to be registered where they are (actually where they are principly used) sales tax will be collected wherever they are sold. I have not heard of a state giving a break to GIs on sales tax except when it is to be registered in another state, that state will want it's sales tax when it is registered. I would ask for a break on the late fee you stand a pretty good chance I think asking from Iraq. Automobiles are a different story as far as registration goes, most states allow military members to maintain a vehicle registration and a drivers license in their home state. There is a three state rule however you cannot have registration in one license in a second and reside in a third. Enjoy your deployment though it is no fun while you are there you will be glad you had the experience when you get home. Getting much sailing in over there?

Location of principal usage ..... Almost all states demand sales tax if the boat is kept wthin their boundaries/jurisdiction beyond their 'grace' period ... and no matter if the boat is bought there, just visiting, or just passing through on a truck, etc. Go to the Boat US website and follow the links to the list of state's grace period. This also means that if you change the location of the boat from one state to another you can socked with another tax bill if you exceed the 'grace' period and the state you are now located in has a higher tax % than where you first bought the boat. This all becomes clear if you acknowldege that the sole 'purpose' of citizens is to be simply nothing more than prey species to pay taxes to 'governments'. By owning a boat you will now find out what it means when you hear "sock it to the rich".

Taxes Levin, Back in the 70s I was stationed in CA as a non CA resident. For autos there was a form that got you out of paying CA sales taxes on cars even though you had CA tags. Not sure what the rules are now but worth checking. Good luck with the taxes and Iraq. Les

Also be prepared for your yearly property tax bill. They will catch up with you and charge you for all past years. A H340 will run about $6-700.00/year. The broker should have informed you about all of these fees/taxes! I also would have thought that the broker should have collected and paid sales taxes on the transaction. I don't know if your eliglble for any type of exemption for military service, hope so! Good luck in your deployment, be safe! Dwain 98 H340 San Diego

Taxes Levin, There is an exemption for military for the property tax, as long as your are not a resident of the State of California. I also believe that it extends to the sales tax as well. To get the exemption on the property tax, you need to list your home port as one in your state of residence, and not a home port in California. The county assessor will send every boat kept in its county a tax bill. And when assessor sends you a property tax bill there is a place on the form to sign off as an out-of-state resident that is stationed in California in the military. The property tax is then waived. As for the sales tax, the rate varies by county, but it is 7.75% to 8.25% (same as the sales tax in stores), depending on where you keep your boat. However, if you register it out of state, there should be no tax. The sales tax is collected by the DMV if your boat is state registered, and the broker should have followed through better to arrange for the tax here if needed. I know when I bought my boat using a broker, he was very careful about making sure the State of California got their share, and my vessel is a documented boat! Good luck and keep up the good work!

You're likely liable From your description, it sounds like you took delivery of the boat in California, and it remains in CA, although you intend to move it to Tennessee in the future. If that's true, you probably owe the tax to CA. The rate sounds high though. In California the tax rate varies by city and county. In San Dego County, the rate is 7.75% of the amount of the sale. So for a sale amount of $81K, the tax would be $6278. How did the California Board of Equalization determine the amount of the sale? Did you provide them the sale documents? When you buy thru a broker, the broker is not required to collect the sales tax from you, although he may choose to do so. If the broker doesn't, then you are responsible to file a return (a "use tax" return rather than "sales tax", although the rules are the same). The fact that the boat is documented is irrelevant as to whether you owe the tax. (Although, if it had been registered with California rather than documented with the USCG, the California DMV would have collected the tax when title was transferred, and you wouldn't be looking at penalties.) And yes, California also has an annual personal property tax, collected by the county the boat is in, based on a percentage of the boat's value. The rate of the property tax also varies based on where the boat is berthed, but is usually about 1.2% of value. San Diego County will catch up to you for the property tax from the change in USCG documentation. You owe the property tax for the year if you owned the boat on January 1 of any year, even though you may have later sold it or move it out of the county. If you move it out of the county, it is your responsibility to notify the county assessor of that fact, otherwise they can continue to collect the tax until they are notified. When you move the boat to TN, most states will give a credit for sales tax paid to another state, depending on how long the time lag before it is moved to the new state, so that you don't have to pay the sales or use tax twice to two states. You need to check with TN and see what they will do. There are provisions for relief from penalties for reasonable cause and circumstances beyond your control. Generally, ignorance of the law is not an excuse. Deployment overseas may be. I'm not aware of any exemption from the sales tax for that fact, though. Here are some publications from the California Board of Equalization: Info on vessels in general: http://www.boe.ca.gov/pdf/pub52.pdf Info on documented vessels: http://www.boe.ca.gov/pdf/pub79.pdf Info on penalties & interest: http://www.boe.ca.gov/pdf/pub75.pdf Application for penalty relief: http://www.boe.ca.gov/pdf/boe735.pdf Good luck! (BTW, I'm a California CPA.)

All I can say is, welcome to California..... paying a sales tax plus yearly property tax is the main reason why I have not bought a bigger boat.

Taxes... sigh... Thanks everyone for all your input... Like I said I bought the boat in about August of 2005 and I'm just now getting this bill. I'm not sure how they assessed the value of my boat but they must not be using $81,000 as what is worth or I would owe a fair bit less sales tax. Does anyone know how to petition the board if they are using a number other than $81,000 to charge me sales tax? Also when I registered my boat with the USCG I just kept the hailing port the same as it had been when the old owner had the boat... which means it still "Coronado CA". As I understand it when I went and researched the laws regarding the military and property taxes (not sales tax... I don't think there is a way around this) I believe I'm exempt from this, but does anyone know if I have to have a hailing port outside CA to get the exemption... and if so how do I get my hailing port officially changed? I think that's it for the questions... as always thanks everyone for all the help. -Levin

And more taxes... When I bought my current boat, I bought it from a commander in the Navy who was stationed in Port Hueneme. He was the one that told me about the exemption from property taxes. According to him, he had to register the boat with a hailing port in his home state, and then had to be able to show he was not a California resident. You can change the hailing port with the USCG.

The property tax is based on where the boat is located. Hailing port is irrelevant. If there is no instruction in your billing to do otherwise to appeal the sales tax billing, I'd simply write a letter to the California Board of Equalization and send them copies of your purchase documents showing the purchase price, and tell them they've made an error in calculation, and what your figures show it should be. Explain that you're not a CA citizen, are deployed overseas, and that the broker didn't explain your responsibilities for sales tax when you bought the boat. And ask for them to waive the penalties. You can get an exclusion from property tax by declaring that the boat is to be taxed for property tax purposes at your home in TN for the period you're on active duty. The form for the declaration is BOE-261-D, which is not available on the BOE's website. You have to request it from them. Here's a letter from the CA Board of Equalization to county assessors on the subject of the tax on personal property for active duty military: http://www.boe.ca.gov/proptaxes/pdf/lta03036.pdf

Off the hook? How do you think your trip to Iraq gets paid.

Death and taxes... Thanks again everyone... And a special thanks to Pete... all those links were a big help. I think I have it figured out now. I will have to pay the $6,278 in sales tax, but hopefully after I petition the board perhaps that will be all I'll have to pay. Like I said thanks for all the info and help figuring this all out. Take care, -Levin

- This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. By continuing to use this site, you are consenting to our use of cookies. Accept Learn more…

Official websites use .mass.gov

Secure websites use HTTPS certificate

A lock icon ( ) or https:// means you’ve safely connected to the official website. Share sensitive information only on official, secure websites.

- search across the entire site

- search in Massachusetts Department of Revenue

Log in links for this page

- Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect

- Pay Sales or Use tax (Form ST-6) or Claim an Exemption (Form ST-6E) with MassTaxConnect

- This page, Sales and Use Tax on Boats, Recreational OHVs, and Snowmobiles, is offered by

- Massachusetts Department of Revenue

Sales and Use Tax on Boats, Recreational OHVs, and Snowmobiles

Updated: June 5, 2023

Table of Contents

When is sales or use tax due, sales made in massachusetts (including to nonresidents).

Unless exempt, a sales or use tax is due on:

- Boats (including documented boats)

- Recreational off-highway vehicles

- Snowmobiles.

If you do not pay sales tax to a registered dealer in Massachusetts, a 6.25% sales tax is due by the 20th day of the month following the:

- Other consumption.

For example , if you buy a boat in Massachusetts on June 1, sales tax would be due by July 20.

Private sales made outside of Massachusetts

A 6.25% use tax on your purchase is due by the 20th day of the following month that it entered Massachusetts, if your purchase was:

- Bought outside of Massachusetts from a private party and

For example , a use tax would be due by July 20 if you:

- Bought a snowmobile in New Hampshire on January 1 and

- Brought it into Massachusetts on June 30.

Dealership sales made outside of Massachusetts

What if you buy from a registered dealer outside of Massachusetts?

If you paid a sales tax of 6.25% or more to another state, you do not have to pay a use tax to Massachusetts.

You would owe Massachusetts the sales tax difference if you:

- Paid less than a 6.25% sales tax to another state and

- Brought your purchase into Massachusetts for use within 6 months.

Visit TIR 03-1 for more information about use tax paid to another state.

6 Months Rule

The 6 months rule can be disputed depending on the facts of the purchase.

To be considered purchased for use within the state, your purchase does not need to be used:

- Even primarily in Massachusetts.

You may still owe use tax if your purchase is brought into Massachusetts after 6 months.

Visit Directive 87-3 for more information.

Mass. General Laws

For sales and use tax dues dates and what is taxable, visit Mass. General Laws:

- Chapter 64H

- Chapter 64I .

Do you need to register?

To register , you must first file and pay your sales or use tax, or file for an exemption on your:

- Recreational off-highway vehicle

- Snowmobile.

Pay Sales or Use Tax with MassTaxConnect's Form ST-6

Filing Form ST-6 with MassTaxConnect is your fastest option.

Before you begin make sure:

- Your pop-up blockers are turned off and

- You do not log into your MassTaxConnect account if you have one.

- You can not pay sales or use tax with a credit card.

You will need the:

- Seller's name and

Type Unknown if the address is unknown.

You will also need the vehicle information including:

- Description of vehicle

- Date of sale

- Gross sales price

- Serial number (also known as a VIN)

- Engine size

- Length and mooring location (boats only).

Getting started

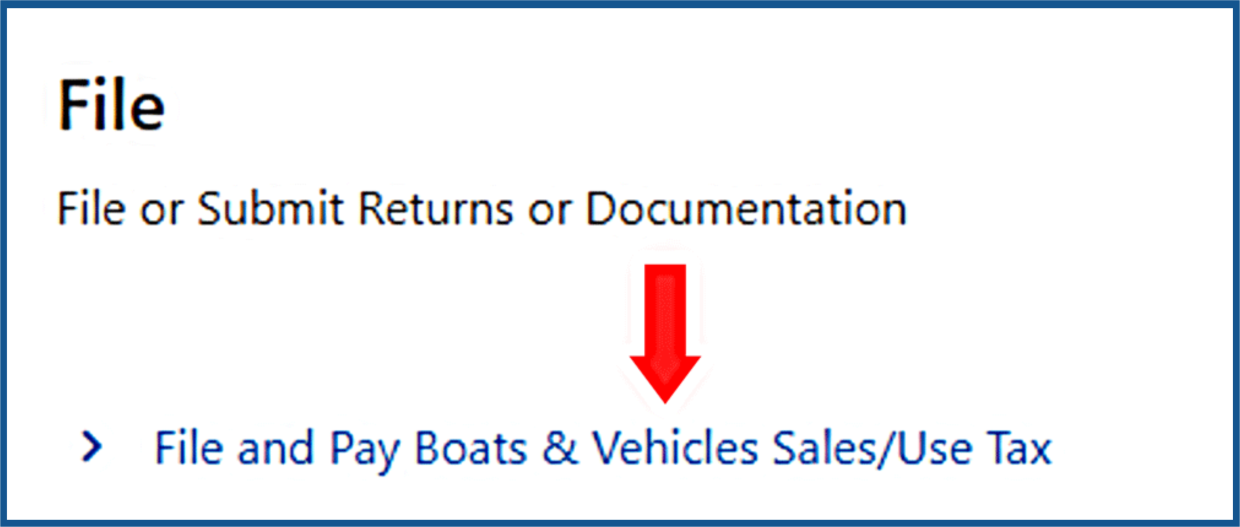

At the bottom left of MassTaxConnect's home screen :

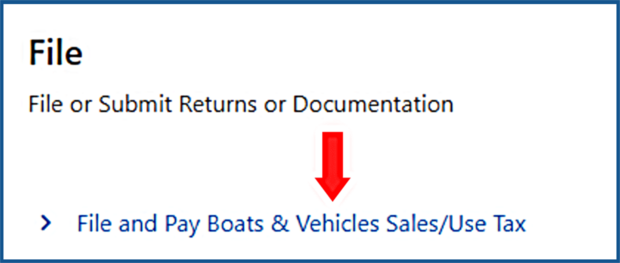

Step 1 : Select File and Pay Boat & Vehicles Sales/Use Tax .

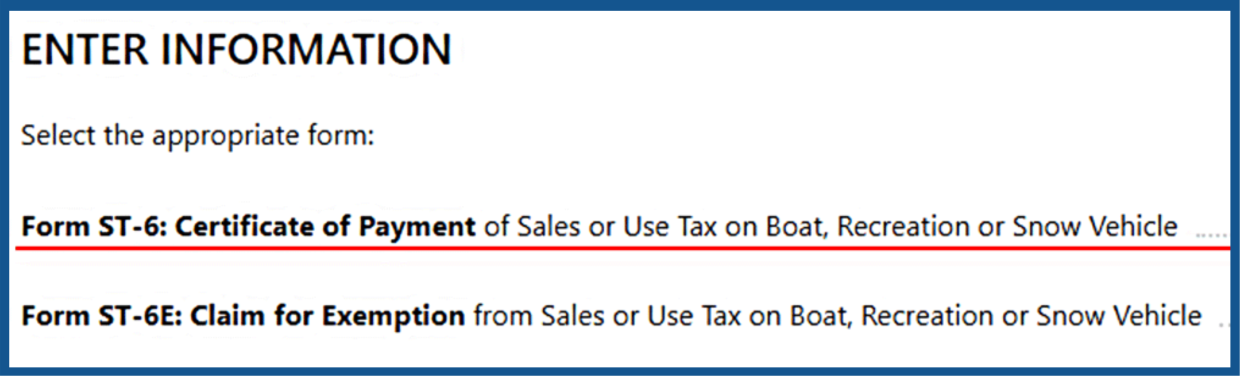

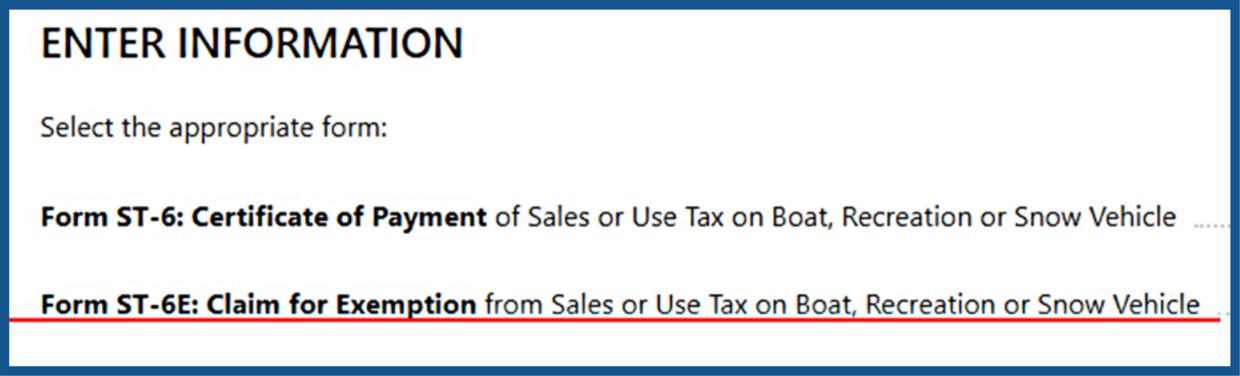

- Step 2 : Select Form ST-6: Certificate of Payment from Sales or Use Tax on Boat, Recreation or Snow Vehicle.

When finished, b efore clicking on OK , don't forget to print:

- A copy of the confirmation page, then

- Two copies of the Form ST-6 payment receipt.

Keep these copies for your records.

If you click on OK before printing your ST-6 payment receipt, you can get copies of your receipt by:

- Selecting Find a Submission under Quick Links.

- Visit the Find a Submission tutorial video .

You can only print a copy of your payment receipt if you filed a Form ST-6 using MassTaxConnect.

Visit the File and Pay Form ST-6 tutorial video .

To register , you must show your exemption certificate.

Get your ST-6 receipt from a registered dealer