How To Afford Buying a Catamaran: Owners Lessons Learned

As an Amazon Associate, we earn from qualifying purchases. We may also earn commissions if you purchase products from other retailers after clicking on a link from our site.

The catamaran of your dreams has just shown up on Yachtworld.com. The only question now is where the money will come from to buy it. To help you navigate the options I have asked 100+ owners of catamarans how they purchased their catamaran and what they learned from it!

You can finance a catamaran from your savings, borrow against home equity, or take out a loan from a bank or specialist boat lender. You could also use your stock portfolio as loan collateral . A third way is to use a management program. Before you choose, listen to these owners’ experiences.

In many ways, financing a catamaran is similar to financing a car. The only difference is you may need to borrow more, depending on your choice of catamaran and your down payment. Keep reading as we explore what sailors experienced when they bought their cat.

Table of Contents

Owners Recommend: Use Your Own Savings

This is the number one recommendation I got, I might not totally agree, but this is what most of the respondents answered (~80%), and the main reason was this:

The lesson to be learned is never go into debt for a depreciating asset like a boat. Poll respondent #23

One of the better consequences of the COVID-19 pandemic is that the personal saving rate has increased significantly. At least amongst higher income groups.

So, if you’re one of those people who have stashed away more of your money, those savings could be an excellent way to finance your catamaran. But be cautious: you don’t want to sink all your cash savings into this. You should ensure you’ll have more than enough for contingencies, especially in uncertain times. How much you should keep in cash savings will vary according to your circumstances and who you ask .

If you want to understand the costs of the liveaboard lifestyle, I suggest that you read this article where I summarize the costs of living aboard a cat.

In general, aiming to keep around twelve months’ living expenses is sensible if you’re planning on using savings to fund a luxury purchase. That should give you enough leeway if you hit an unexpected financial storm and need to batten down the hatches.

Saving our butts off to be able to buy it and not use a loan Respondent #56 and her very straight forwards explanation

If you can do that and still have a lot of excess cash in a savings account, using it to finance your catamaran may make sense. That’s because interest rates are so low at the moment, so your savings may not be keeping pace with inflation . Even though borrowing rates are also low, you’ll still pay more to borrow than you’ll earn on your savings. So, if you look at the lost interest as the cost of using your savings, it works out much cheaper than a loan. Or in other words:

I paid cash. If financing is an absolute necessity to buy your boat, you need to reconsider if you can really afford it. Poll respondent #36

Use the Equity in Your Home

If your home is mortgage-free or you have enough equity, financing your catamaran with a home equity loan can be a relatively cheap option.

Some respondents considered this option but non actually did go through with it, the main reason seemed to be that instead of owning a house and boat, they sold the house and used the money to buy a boat. Gabo

Of course, it means your home is collateral for the loan, so you risk losing your home if you fail to make the loan repayments.

However, because your home is security for the loan, you should get a lower interest rate than you’d get on an unsecured loan. Though you may have to shop around to get the best rates.

With this option, you’ll benefit from loan terms that are longer than what is usually given for unsecured loans; you may be able to choose anything from 5 to 30 years, depending on the lender. The term length helps to keep the monthly repayments down.

You should be aware that home equity lenders usually restrict the amount you can borrow. The limit is often to a maximum of 85% of your property’s value. That shouldn’t be a problem if you don’t have an existing mortgage. But if you do, your existing mortgage will reduce the amount you can borrow, and you’ll need to check how much you can borrow to ensure it’s enough to cover the cost of your catamaran.

Also, bear in mind that many home equity loans come with fees payable on closing. There may be other fees to take into account as well, like appraisal costs.

Still, shop around, and you can find home equity loans with no closing fees at both national and regional banks . It pays to do your research.

Unsecured Bank Loan

If you don’t have enough home equity or are uninterested in securing a catamaran loan against your home, another way to get your dream of catamaran ownership afloat is to go for an unsecured bank loan.

One important thing to consider when deciding if an unsecured loan is the amount you can borrow. Many unsecured loans max out at around $50,000, though $100,000 is available from some lenders.

Another factor to bear in mind is most unsecured loans have a maximum term of five to seven years. So, if you’re borrowing a large sum, this option can prove more costly than a secured loan.

On the plus side, like a home equity loan, unsecured loans have fixed repayments, and you know what your monthly commitment will be from the start.

Another advantage is that you’re not using your home as collateral, so it’s not at risk if you fail to meet the repayments. Of course, you could end up with a poor credit rating if you miss repayments; thus it’s still crucial to make certain you can afford the monthly commitment.

If you go down the unsecured loan route, check your lender’s small print for hidden fees. Some lenders charge origination fees, which can add to the overall cost of the loan.

It’s also often helpful to have the option to prepay if you want. Yet know that some lenders charge prepayment fees that can effectively tie you into a loan and prevent you from refinancing it should you find a cheaper option. Again, just check the small print before signing on the dotted line.

An alternative to a standard bank loan to finance your catamaran is a boat loan. These are available from specialist boat lenders and other lenders.

How Does a Boat Loan Differ From a Bank Loan?

With boat loans, you can often use the boat you’re buying as collateral. That translates into potentially lower repayments because the lender has security for the loan in the shape of your boat.

Also, the loan terms are often longer than for standard bank loans, reducing the monthly repayment.

Many boat buyers prefer this type of secured loan over one secured on their home. That’s understandable since the consequences of losing your boat aren’t as dire as losing your home.

The option of a boat loan stirred up a somewhat emotional debate where there seemed to be two sides, one side saying it makes sense since you’ll be able to invest the cash you already have:

Line of credit. Pay interest only. Keep your money working for you. Respondent #87

And the other side presenting an interesting perspective:

I don’t think I could ever look at the horizon in my catamaran and fantasize about just keeping on going while flipping the bird to everything behind me with a bank loan on it. Kind of defeats the purpose for me. I would feel like I’m dragging my hook behind me! Respondent #78 discussing the emotional aspect of taking a loan

Back to the loans! Some specialist boat loans require a downpayment. Meaning you won’t be able to borrow the total cost of the boat. A down payment may range from between 10-20%, and by putting in more capital upfront, you get the benefit of lower repayments.

Be aware, some boat lenders may have conditions around the type and age of the boats they’ll finance. There may also be minimum and maximum loan amounts. With some loans, there may also be fees to pay. Always check the lending terms carefully.

Examples of Available Boat Loans

One lender in the boat loan market is Bank of the West , through its Essex Boat Loan arm. Here are the main points to note about its boat loans:

- Its minimum loan is $10,000, with a maximum of $500,000.

- Interest rates are higher for smaller loans.

- There are down payment requirements that vary depending on the loan amount.

- It prefers a credit score of at least 700.

- There are processing fees to pay.

If you want fee-free options, they are out there if you shop around. For example, look at Truist , previously SunTrust:

- It will lend on new or used boats of 30’ (9m) or more.

- The minimum loan is $100,000.

- The maximum term is twenty years if you have a 20% downpayment.

- They’re one of the lenders that will take your boat as collateral.

If you’re not looking to borrow as much as Truist’s minimum loan, its online lending arm, Lightstream , fills the gap:

- It offers boat loans of between $5,000 and $100,000.

- Its maximum loan term is forty-eight months.

- There’s no restriction on the type or age of boat you can buy.

- It doesn’t take your catamaran as collateral.

- However, your credit score needs to be good to excellent to qualify for a loan.

These are just some examples of the boat loans available. As you can see, lender’s terms can differ significantly, so shopping around is vital.

Dealer Loan

If you’re buying your boat through a dealer, it’s worth exploring what help they provide on the financing front.

They’ll have experience and knowledge of the boat loan market. Plus, the dealer does all the legwork. This saves you the time of researching available options yourself, making it a very convenient way to get finance for your catamaran. It can also be reassuring to have a hand to hold throughout the process.

Stock Portfolio Loan

If you’ve got a stock portfolio, you might be thinking about liquidating some or all of it to finance your catamaran–certainly a strategy worth looking into. However, if you have a substantial portfolio and want to keep it, consider using it as collateral for a loan. That means your portfolio is security for your loan. (Note: you need a substantial portfolio if you want to finance your catamaran using this type of secured borrowing.)

Some providers allow you to borrow up to 90% of the value of your holdings, but borrowing at such a high loan to value on this type of finance isn’t a good idea. That’s because if your portfolio value drops, you’ll have to reduce your borrowing to maintain the loan-to-value ratio below the provider’s maximum.

If you don’t reduce the borrowing, the provider could sell some of your holdings, which means you won’t necessarily get the best price. There may also be tax implications from the sale.

Indeed, this type of borrowing is not without risk, and it won’t be suitable for everyone.

If you decide to go for it, it’s sensible to limit borrowing to not more than 20% of your portfolio value. This should provide a comfortable buffer to protect against market fluctuations. But remember, even that’s not guaranteed.

Rent Out Your Catamaran

Renting out your catamaran once you’ve bought it is another option you can use to help finance the purchase.

It pays for winter storage and summer dockage, a portion of the boat loan, maintenance. It gets me in the water more even [often]. Great for my taxes. Works for me Respondent #55

The idea is along the same lines as Airbnb. One site through which you can rent out your catamaran is Get My Boat . It allows a boat owner to list their catamaran for short-term rental in return for a fee.

There are a couple of ways to do this. The first is for you to captain the boat during the rental period. The second is to offer bareboat charters where you hand over your catamaran for the agreed rental period.

With the first option, you’ll need to have the time to captain your catamaran for the whole of each rental period.

If you don’t have that sort of time, the second option might suit you better. However, it does mean letting someone else take over your catamaran for the agreed period. So, you’ll want to ensure you have insurance to protect your investment.

Although renting out your catamaran means there’ll be times when it won’t be available for your own use, it’s up to you to accept or reject bookings. So you have some control over when you rent it out and the length of bookings you accept.

You’ll still need to maintain your catamaran and clean between rentals. If you do the cleaning yourself, that’s more of a time investment for you. But if you pay someone else to clean it, that’s an expense that will come out of your rental charges.

However, you can see how you can use this type of scheme to meet all or part of your monthly loan repayments. If you choose to finance your catamaran from your savings, it can provide a way to rebuild those depleted savings fairly quickly.

Whether you captain your catamaran or not, this option for financing your purchase will involve a good deal of your time.

Use an Ownership and Management Program (Chartering)

Around 10% of the respondents said they have good experiences with chartering their cats as a way to stay within budget.

I charter with my boat. Makes the cost make sense Nathan (#86)

If you’re interested in financing your catamaran by renting it out but the time involved is off-putting, this option may be more suitable for you. The idea of an ownership and management program is that you buy your catamaran. Then you allow a company, like Navtours , to charter it out.

That company pays you a fee in return for the use of your boat. And they’re responsible for managing charters, marina fees, and maintenance costs.

The downside of this is that you lose some control over when your catamaran is available for your use. Though many companies should let you choose the type of management agreement you want.

For example, Navtours offers two options: One gives you access to your boat for twelve weeks of the year, the other requires you hand your catamaran over for a more limited time, allowing you to use it as you please for most of the year.

With both options, you can generate an income from your catamaran. That income will be lower under the second option because it’ll be out for charter less of the time.

As with renting, you need to be comfortable with other people using your catamaran. However, with a program like this, you’d be entering into a contract for five years. With the last option, it’s up to you how long you continue renting out your boat.

Things To Think About When Financing a Catamaran

However you choose to finance your catamaran, it’ll involve a significant outlay. Let’s discuss a couple of things you can do if you want to sail through the process smoothly.

What’s Your Intended Use?

If you choose to go with a boat loan, make sure that they allow you to do the things that you intend to do, some loans will have geographical limitations as to where you can go.

Some banks restrict your cruising grounds as they don’t want their collateral sailing away [for example] to Madagascar. Scott (#51)

Check Your Credit Score

As you’ve seen above, if you want a loan to finance your catamaran, you’ll need to meet lenders’ credit score requirements.

Knowing your credit score in advance is important because it helps you rule out some lenders that you know will turn you down, saving you time on unnecessary applications. Also, hard lender inquiries on your credit file might hurt your score.

While some lenders ask for at least a good credit score, others may be less stringent. That’s why you should shop around. An average or even poor credit score needn’t sink your dream of owning a catamaran . If your credit score isn’t quite up to scratch, think about ways to improve it. For example, you could pay down debt to reduce your borrowings or to reduce your credit utilization .

Get a Boat Survey

You’ll need a survey if you’re taking a loan secured on the boat. Though, regardless the way you decide to finance your catamaran, this will be money well spent. Even if you go the unsecured route or finance your catamaran from savings or a home equity loan, a survey will give you peace of mind.

Proceeding without a professional survey is risky. Remember, the catamaran of your dreams may look okay from the outside, but your untrained eye could miss potentially costly issues–a sure way to capsize your dream of owning a catamaran.

As you can see, if you’re looking at how to finance a catamaran, there are several options. Weigh them all up carefully and don’t go full steam ahead into anything. Take your time to steer a steady course through the available options to find one that suits you.

Remember, don’t use savings if it’ll leave you short of cash to deal with life’s headwinds. If you’re borrowing, shop around for the best rates and terms. In particular, give a wide berth to loans that tie you in with penalties for early repayment. Good luck and happy sailing!

And remember BOAT actually means Break Out Another Thousand! 😉

So what does it cost to maintain a catamaran?

- St Louis Fed: Personal Saving Rate

- Smart Asset: What is the Average Interest Rate for Savings Accounts?

- ING: US Inflation: The Only Way is Up!

- Santander Bank: What is a Home Equity Loan?

- Bank Rate: Best Home Equity Loan Loan Rates for April 2021

- US Bank: Home Equity FAQ

- Regions: A Quick Guide to Your Regions Home Equity Loan

- Bank Rate: Best Personal Loan Rates for April 2021

- Discover: A Quick Primer on Personal Loan Agreements, Terms, and Prepayment Penalties

- Bank of the West: The Essex Boat Loan Advantage

- Essex Credit: Boat Loan Rates

- Essex Credit: Boat FAQ

- Sun Trust: Marine Boat Loans

- Experian: What is a Good Credit Score?

- Youtube: Financing a Boat and What Works Best

- Wells Fargo Advisors: Securities-Based Borrowing

- Get My Boat: Boating Experiences Worldwide

- Boat Bookings: Bareboat Yacht Charter

- Boat Charter Insurance: Are You Looking for Marine Insurance That Protects You For Personal and Charter Use?

- Nav Tours: Yacht Ownership

- Experian: How to Improve Your Credit Score

- Experian: What is a Credit Utilization Rate?

Owner of CatamaranFreedom.com. A minimalist that has lived in a caravan in Sweden, 35ft Monohull in the Bahamas, and right now in his self-built Van. He just started the next adventure, to circumnavigate the world on a Catamaran!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Recent Posts

Must-Have Boat Gear for Catamaran Sailors!

Sailing is probably the most gear-intensive activity I've ever done; there are so many decisions to be made about what gear to buy now, for tomorrow, and what to definitely never buy. The gear on...

6 Best Trailerable Trimarans For Bluewater and Coastal Sailing

Having a boat costs a lot of money, even when you are not using it, marina fees, etc. And once it is in the water most sailors never go very far from their "home marina" and sailing will be somewhat...

Catamaran financing

Have you found the boat of your dreams and are now looking for the best way to finance it? At Nautitech, we know that buying a catamaran is a big investment. For those who are about to become an owner, the question of how to finance your purchase is not to be taken lightly. Trust Nautitech's team of experts! We are detailing financing options for purchasing a catamaran. Acquiring a boat, via a bank loan or through a lease-purchase... Each solution has its pros and cons and will be suited, or not, to your project.

The purchase of a catamaran in cash

When the buyer has the necessary funds and is able to invest them directly in the project, the purchase of a catamaran in cash is a first possibility. While this method offers advantages, such as the quick purchase process, there are also disadvantages, such as mobilizing a large part of the buyer's finances in a single, relatively substantial financial project. If you want to buy your catamaran with cash, contact our team now! We will be happy to assist you and help you enjoy your new boat very soon.

Purchase a catamaran via Loan Financing

When the future buyer does not have the funds available, or if he wishes to preserve liquidity to be able to carry out other projects at the same time, he may take out a loan. This is the traditional method of financing to purchase a boat. It’s also fast and the method that boaters very often use! Like any other bank loan, or personal loan, the characteristics depend on the applicant's situation and the amount of his contribution. The repayment period for a catamaran loan ranges from 10 to 25 years, also depending on the possibilities of the future boat owner.

If you are interested in this financing method the acquisition of your multihull and would like to submit a loan application, the Nautitech team will be happy to put you in touch with financing professionals. Among them, La Victoire Finance is a trusted organization for the American market. LIZmer offers a credit solution for the French market.

The LOA solution (Lease-Purchase Option), A tailor-made solution for catamarans

To finance a catamaran, there is also the option of leasing, called the Lease-Purchase Option, or Equipment Leasing when the contract holder is a company. With a lease, the buyer chooses a financing solution for his catamaran that allows him to preserve his cash flow: the catamaran chosen is purchased through a third party – a bank, which leases the boat to him for a longer or shorter period. The lease term is defined, in advance, according to the buyer's financing possibilities. Once this term expires, the buyer proceeds with acquisition of the catamaran to become its effective owner, thanks to the purchase option.

Jean-Marie Naudin, LIZmer business representative – a brand of Capitole Finance-Tofinso – explain: "At LIZmer, we offer long-term support, thanks to a tailor-made offer. Every project is unique and we always propose the most suitable solution for our customers. For example, a client planning an extensive journey by sailing outside the Community's territorial waters may, under certain conditions, benefit from a complete VAT exemption on their lease payments within the framework of a leasing contract for financing a catamaran". LIZmer, which is specialized in boat financing for more than fifteen years now, has a stand every year at all major French boat shows.

Among the advantages of a lease-purchase of a catamaran, there is the possibility of having several lessees, of adjusting the contract along the way – for early repayment, for modification of the conditions of direct debit – as well as transferability of the contract. This is good to know in case a buyer might wish to resell the boat being financed.

Catamaran leasing contracts can also be adjusted, which means that the buyer can choose to add certain items to his multihull financing contract, such as electronic equipment, sails or on-board instruments. Finally, since the bank owns the catamaran until the end of the rental period, the boat is not part of the assets of the future buyer before this date. An advantage to be taken into account from a tax perspective !

Are you thinking of buying a catamaran under a leasing arrangement ? There are many organizations that can assist you with financing a catamaran under a lease-purchase agreement. Most even offer free simulations. Among them, LIZmer and CGI Finance are highly recommended. Trust us with your project, our team can help you !

Reasoning for a Navigation Program and Project Duration

To finance a catamaran purchase, there is no one-size-fits-all answer. Your pontoon neighbor’s solution may not be the best fit for your specific situation. Each project is unique and should be examined with great attention. There are certain questions to ask yourself. Would you like to sail for a few weeks a year, close to your home, or do you want to leave tomorrow, sailing around the world for an indefinite period? Do you expect to still be sailing in 5, 10, 15 or 20 years? If you have trouble defining your long-term plans, our specialist team can also help you. Let's develop your navigation plan together and select the financing method that suits you best! Whatever the solution considered for purchasing your catamaran, know that Nautitech is available to assist you. We will be happy to guide you to the ideal financing partner, to make your planned purchase a reality.

You would like to be supported in your project

Service Locator

- Angler Endorsement

- Boat Towing Coverage

- Mechanical Breakdown

- Insurance Requirements in Mexico

- Agreed Hull Value

- Actual Cash Value

- Liability Only

- Insurance Payment Options

- Claims Information

- Towing Service Agreement

- Membership Plans

- Boat Show Tickets

- BoatUS Boats For Sale

- Membership Payment Options

- Consumer Affairs

- Boat Documentation Requirements

- Installation Instructions

- Shipping & Handling Information

- Contact Boat Lettering

- End User Agreement

Frequently Asked Questions

- Vessel Documentation

- BoatUS Foundation

- Government Affairs

- Powercruisers

- Buying & Selling Advice

- Maintenance

- Tow Vehicles

- Make & Create

- Makeovers & Refitting

- Accessories

- Electronics

- Skills, Tips, Tools

- Spring Preparation

- Winterization

- Boaters’ Rights

- Environment & Clean Water

- Boat Safety

- Navigational Hazards

- Personal Safety

- Batteries & Onboard Power

- Motors, Engines, Propulsion

- Best Day on the Water

- Books & Movies

- Communication & Etiquette

- Contests & Sweepstakes

- Colleges & Tech Schools

- Food, Drink, Entertainment

- New To Boating

- Travel & Destinations

- Watersports

- Anchors & Anchoring

- Boat Handling

- ← Products & Services

Finance your dream boat

Here’s what you need to know.

Working with leading marine lenders, our partners are able to offer competitive rates and terms to help you purchase a new boat or refinance your existing boat loan. We offer loans for powerboats, sailboats, multi-hull boats, pontoons, and even personal watercrafts.

Use our Boat Loan Calculator to determine a monthly payment that’s right for you, then fill out an Online Loan Application for our lending partner to underwrite.

- If you are applying for a loan for $25,000 or greater, click here to apply online .

Once your application is completed, a representative will evaluate the application to determine the next steps, in an effort to make the closing process as seamless as possible.

Calculate Payments with Our Boat Loans Calculator

Use our boat payment calculator to determine a monthly payment that you can afford when looking to finance a new or used boat.

Simply enter your desired amount, estimated interest rate, and the loan term over which you intend to pay back the loan. Once you've input the information, the calculator will generate your estimated monthly payment on your boat loan. Take this number and plug it into your current monthly budget.

Boat Loan Calculator

Monthly Payment

Total Loan Amount

Your Monthly Payment is:

Your Max Loan Amount is:

Helpful Terms and Phrases

Monthly Payment What you're paying out of pocket every month to repay your loan.

Number of Years How many years you're looking to pay back the loan (term of loan).

Interest Rate Interest rate accompanying this type loan.

Total Purchase Price This is the total cost of your boat purchase. Don't include sales tax in this amount.

Down Payment This is the total out-of-pocket amount you are paying toward your purchase. Standard down payment is 15% but depending on your boat age, loan amount, and loan term the required down payment can be between 10% - 30%.

Deposit This is the total amount you have already paid toward your down payment.

Trade Allowance The total amount that you are given for any vessel that you trade-in as part of this purchase.

Amount Owed On Trade Total loan balance outstanding on the trade-in.

To get started, you will need to complete the Online Loan Application. Our lending partner will do an initial review and credit inquiry and likely will request additional financial information such as tax returns or bank statements to help them make a decision. Once approved, the lender will list any additional items needed prior to closing (for example, a marine survey and executed sales contract). Next, our lending partner will collect information from the seller(s) to finalize the loan closing paperwork. Once readied, our lending partner will send closing documents to the buyer(s) and the seller(s) for completion. Lastly, our lending partner would send the loan proceeds to the seller(s) in accordance with the funding instructions.

Boat loans share some similarities with both vehicle and home mortgage financing. You will need to complete a loan application for our lending partner to underwrite. Similar to a home mortgage, the bank can ask for your personal federal tax returns, proof of assets, and may ask for additional financial information depending on each situation.

Similar to a vehicle loan, the lender has a loan‐to‐value guideline that is based on the book value for used boats and the contract price for new boats. All of the lender's underwriting criteria must be met to offer approval, and these guidelines tend to be more rigorous than vehicle financing. If approved, the lender would outline any additional items needed prior to closing and closing paperwork would be prepared once all of the necessary information has been collected.

You will need to provide basic demographic and employment information, complete a personal financial statement that lists all your assets and liabilities, and provide us with information on the boat you are interested in buying or refinancing. As part of the underwriting process, our lender will likely ask for tax returns and bank statements for non-retirement and retirement assets to verify your income and net worth, a copy of the sales contract, and a marine survey report (on most used boats). At the end of the application, you can securely upload these documents to help speed up the review of your application.

Most applicants can expect to have a decision on their application in 2-4 business days. Our lenders will often ask for financial information before making a decision.

Typically, our lenders will require a boat to be documented with the United States Coast Guard if it meets the Coast Guard's net tonnage standard. If the boat you wish to purchase is eligible to be documented, our finance department or lender will prepare a First Preferred Ship Mortgage as part of the loan closing paperwork and file it with the Coast Guard as the instrument that secures the bank's lien on the vessel. If the boat is not large enough to be documented with the Coast Guard, a formal mortgage would not be prepared; however, the lender would still record its lien against a state title or equivalent document. In either event, the lien would be released once the loan has been repaid.

Our lenders do not issue pre-approvals that are similar to what you get when purchasing a house. You are able to apply without having a sales contract on a boat, and you aren't locked into buying the boat that you apply with, but you do need to list a boat on the application.

The rates and terms are highly dependent on the boat, so we recommend applying with a boat that is similar in age, length, and type to the one you are interested in purchasing, and use a realistic purchase price.

Credit requirements vary by lender, but our lenders generally require applicants to have a credit score above 680 with no major credit issues such as a bankruptcy, foreclosure, settlement or charge-off within the past 3 – 5 years.

Generally, marine financing is subject to higher credit and other underwriting standards than that for vehicles or even home mortgages. Our lenders look for applicants with better credit, but there are other companies that will consider individuals with past credit issues.

Our lender will first review your credit score and history to determine if you meet their credit guidelines then review your financial information. When evaluating your application, our lender will look to see that you currently have the funds to make the down payment without depleting your assets, and verify your net worth and debt-to-income ratio (monthly debt payments divided by monthly income) meets their guidelines. They will also review the boat to ensure the purchase price is in line with the market value of the boat by using third-party valuation guides like NADA, BUC and ABOS.

The loan term available will largely depend on the boat you select. We work with banks that can offer terms up to 20 years, subject to the age and type of boat, as well as the loan amount available from the lender.

Once the lender collects all the required information from the buyer and seller, both parties will receive paperwork that they need to sign and notarize. Once the lender receives the paperwork back from both parties, they will disburse funds in 1-2 business days. The buyer and seller do not need to visit a bank or be in the same place to close the loan. If the boat is currently financed, our lender will disburse the funds directly to the lienholder to pay off the loan, otherwise, the funds will be paid to the seller by check or wire transfer.

BoatUS partners with leading marine lenders that consider various types of collateral, including larger, more expensive vessels. Some restrictions do apply — for example, we cannot accept applications for steel‐hull boats at this time.

Use our Online Loan Calculator to determine your monthly payment or enter the desired monthly payment to see the loan amount. to determine your monthly payment or enter the desired monthly payment to see the loan amount.

We recommend you access the NADA Guides Boat Value Online Tool , powered by J.D. Power.

- Loan amounts from $10,000 for boats model year 1998 and newer

- Multi Hull Boats

- Pontoon Boats

We use cookies to enhance your visit to our website and to improve your experience. By continuing to use our website, you’re agreeing to our cookie policy.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Best Boat Loans in 2023: Finance Your Boat

Boat loans can be unsecured or secured by the boat. Compare financing options from online lenders, banks and credit unions.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Setting sail on your own boat is a priceless experience. But unless you’ve saved a lot of cash, you’ll need a boat loan to make your dreams a reality.

Here are lenders that offer boat loans, plus information on how to finance a boat with a personal loan — including unsecured and secured loan options. Learn where to find boat loans and factors to consider before applying.

- 20+ years of combined experience covering personal loans and financial topics.

- Objective, comprehensive star rating system assessing 20+ categories and 70+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity .

- 35+ personal loans reviewed and rated by our team of experts.

Our pick for

Unsecured boat loans

Sofi personal loan.

8.99-29.99%

$5,000-$100,000

LightStream

6.99-25.49%

Achieve Personal Loans

8.99-35.99%

$5,000-$50,000

8.49-35.99%

$1,000-$50,000

7.80-35.99%

Laurel Road Personal Loan

9.49-24.25%

$5,000-$45,000

Rocket Loans

9.12-29.99%

$2,000-$45,000

How do boat loans work?

A boat loan is an installment loan with fixed monthly payments typically over two to 20 years. You can get a boat loan from a bank, credit union or online lender.

Interest rates and loan terms vary based on the lender, the size of the loan, your credit score and income, and whether the loan is secured by the boat or unsecured.

Applying for an unsecured boat loan is typically fast, and some loans can be funded the same or next day after you’re approved. Lenders usually deposit the funds into your bank account, from which you can withdraw the money to purchase a boat.

Secured boat loans vs. unsecured boat loans

Boat loans can be secured by the boat or unsecured and backed by your signature. Here are basic differences.

Secured boat loans

Secured boat loans use the purchased boat as collateral. They may have higher loan amounts, longer repayment terms and lower rates than unsecured loans. The risk is that you can lose your boat if you default.

With a secured boat loan, you may also need to make a down payment, which means you’ll need cash upfront.

Secured loans work best for borrowers who don’t qualify for an unsecured loan, want a higher loan amount and are comfortable with the risk associated with secured loans.

An unsecured boat loan doesn’t use the boat or anything tangible as collateral. Without that backing, rates on unsecured loans may be higher and terms shorter.

Approval for an unsecured boat loan is based on factors like your credit score, income and existing debt.

If you default on an unsecured loan , you may not lose the boat, but you’ll still face consequences, including a damaged credit score and wage garnishment if the lender takes you to court.

Pros and cons of secured and unsecured boat loans

How long are boat loans.

Repayment periods for boat loans vary depending on the type of loan you choose.

Unsecured personal loans typically have shorter repayment periods — two to seven years. If you choose a secured boat loan, your term can be as long as 20 years.

Keep in mind the term you choose affects the interest you pay. Shorter terms have higher monthly payments but carry less interest.

For example, a four-year, $30,000 boat loan with an annual percentage rate of 15% will have monthly payments of $835 and cost $10,076 in interest. The same loan with an eight-year repayment term will have monthly payments of $538 and cost $21,683 in interest.

Use NerdWallet’s boat loan calculator to calculate your boat payments.

What is the average interest rate on a boat loan?

Boat loan interest rates vary by lender. An unsecured boat loan will have an annual percentage rate ranging from 6% to 36%. See the table below for average unsecured interest rates based on your credit bracket.

Secured loans may have lower APRs, with many lenders offering single-digit rates. If you're not sure what credit bracket you fall into, check your credit score for free on NerdWallet .

Where to get a boat loan

In addition to getting a boat loan from an online lender, you can also get a secured boat loan from a bank, credit union or marine lending specialist. Here are some examples.

Secured boat loans from banks

You’re more likely to find secured loans from banks. Banks may offer perks to existing customers, like discounts and favorable loan terms. If your bank offers boat loans, it’s a good place to start.

Secured boat loans from credit unions

Credit unions can offer low-rate secured boat loans to their members. These not-for-profit lenders may look past a low credit score or rocky credit history on a loan application and consider a borrower’s whole financial picture, including the relationship with the credit union.

Your local credit union is a good first stop, though national credit unions also offer boat loans. Navy Federal and First Tech , for example, both offer boat loans with 15-year repayment terms with rates starting below 10%.

Loans from marine lending specialists

Marine lending specialists are financial service companies that act as brokers to find you a boat loan. They secure funding through outside sources such as banks.

Boat loans from marine lenders may have similar rates and repayment terms to personal loans. One advantage might be the ability to work with a specialist who understands the boating business, according to the National Marine Lenders Association.

These loans must be secured by the boat and require down payments from 10% to 20% of the purchase price.

How to get a boat loan

To get boat financing directly from a lender, you’ll need to apply for a loan . Most loan applications are online and require you to submit personal information like your name, address, contact information and Social Security number. You may also need to submit proof of identity, employment and income.

If you’re applying for a secured loan, you’ll want to have information about the boat on hand, including the builder or manufacturer, model, model year and purchase price.

Once you submit your application, you’ll wait for an approval decision. If you’re approved, you may need to visit the bank or credit union to close the loan and receive funds. Unsecured personal loans, especially from an online lender, can typically be closed online and funded the same or next business day.

Can I get a boat loan with bad credit?

Borrowers with bad credit may still qualify for a boat loan. Some online lenders offer unsecured personal loans specifically to borrowers with bad credit.

Secured loans from a bank or credit union may also be a smart option for borrowers with bad credit since approval decisions rely less on their credit.

» COMPARE: Best unsecured loans for bad credit

Alternatives to boat loans

Financial experts don't recommend personal loans for discretionary purposes, particularly if you already carry credit card or other debt. If you can’t afford to buy a boat today, or you’re not quite ready to make the commitment, here are some alternatives.

Save up for the purchase. Consider holding off and starting a savings plan toward buying a boat. You may be able to negotiate a cheaper price by paying with cash, and you’ll avoid paying interest on a loan.

Join a boat club. For a one-time fee and ongoing monthly or annual dues, boat clubs provide access to a fleet of boats for their members and guests.

Consider peer-to-peer rentals. Similar to renting a house on Airbnb, you can temporarily rent a boat through a peer-to-peer rental marketplace, such as Boatsetter or GetMyBoat.

Last updated on April 19, 2022

NerdWallet's Best Boat Loans in 2023: Finance Your Boat

- SoFi Personal Loan : Best for Unsecured boat loans

- LightStream : Best for Unsecured boat loans

- Achieve Personal Loans : Best for Unsecured boat loans

- Upgrade : Best for Unsecured boat loans

- Upstart : Best for Unsecured boat loans

- Laurel Road Personal Loan : Best for Unsecured boat loans

- Rocket Loans : Best for Unsecured boat loans

Frequently asked questions

Boat loan repayment terms are usually between two and 20 years. Unsecured boat loans have shorter repayment terms — about two to seven years — while secured boat loans have longer terms. Calculate your boat loan payments to see how the term affects your monthly payments and overall interest.

You can find secured boat loans for used boats at U.S. Bank and Bank of the West, among others. With a secured loan, a lender may consider the boat's age and how much it has been driven when deciding your rate and loan term. With an unsecured loan , that information doesn't usually factor into your rate and term.

Most lenders want to see a good credit score of 690 FICO or higher on a boat loan. You may qualify for a secured or unsecured boat loan with a lower credit score, but borrowers with fair or bad scores (below 690 FICO) are likely to receive higher annual percentage rates.

Liveaboard Sailboat Budget: A Complete Guide

Last Updated by

Daniel Wade

June 15, 2022

Living aboard a sailboat can be a cost-effective lifestyle, but only if you budget smart, predict expenses, and plan ahead.

In this article, we'll go over the basics of budgeting and what to consider when planning your finances as a liveaboard. We'll also cover the most common expenses that are unique to sailboats, along with how to save money and budget accordingly.

As a liveaboard, you'll need to budget for slip fees, fuel, maintenance, utilities, repairs, and supplies. You'll also need to factor in registration fees and mandatory safety equipment that has a limited service life.

We sourced the information for this article from marinas, maintenance records, and from our experience with sailors who live aboard their boats. Other information was sourced from financial experts experienced in budgeting.

Table of contents

Budgeting Basics

Budgeting is one of the simplest and most important aspects of money management. They don't teach it in schools, but it can be the difference between living well and falling behind. This is especially true on a sailboat because a well-budgeted liveaboard can enjoy a level of financial independence unrivaled by traditional housing.

Before we dive into the specifics of budgeting on a sailboat, we will cover some of the basic rules of managing money. This will make it easier to manage your finances in the unique liveaboard environment.

Managing Income, Savings, and Expenses

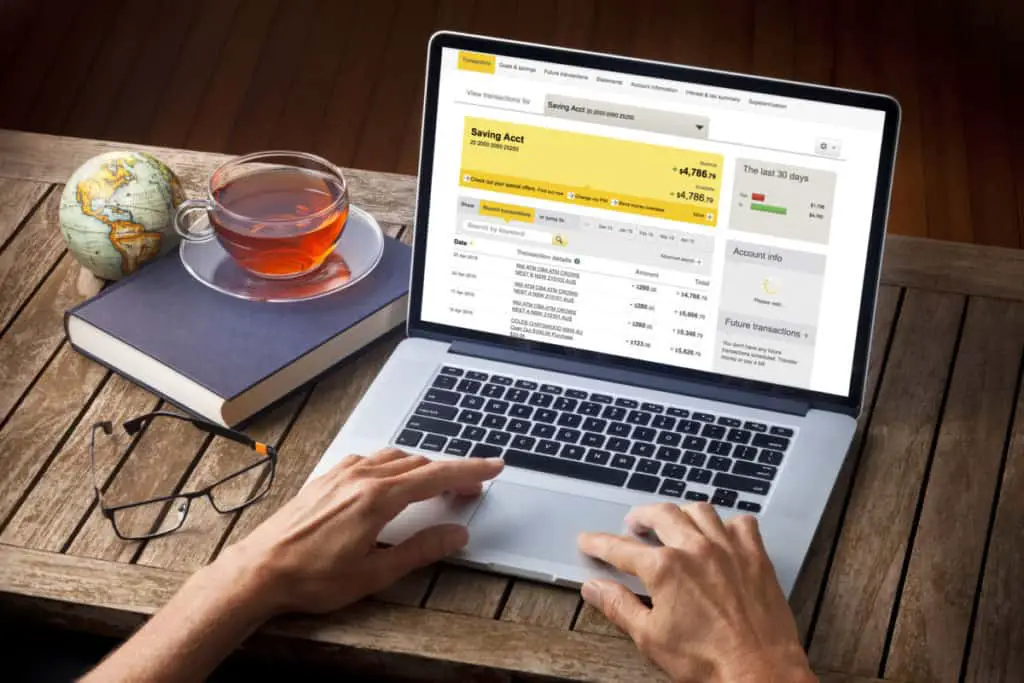

One of the most important rules of budgeting is to be aware of what's going on in your personal finances. You need to figure out how much money you're making, how much money you have, and how much money you're spending.

One way to get a handle on your finances is to audit your bank statements. Figure out how much you're taking home, when your bills are due, how much they cost, and what you have leftover. This includes things such as credit card bills, loan payments, utility expenses, rent, and other recurring expenses.

Once you have a handle on your finances, keep track of them regularly and look for ways to save. This is how you can safely determine how much you can afford to spend.

Emergency Fund

Everyone, especially liveaboards, should have an emergency fund if they can afford it. An emergency fund is a chunk of change that you don't touch unless you absolutely need to. For most people, $10,000 is the ideal emergency fund balance. It can cover everything from emergency medical bills to job loss, and it can also cover expensive sailboat repairs.

Budgeting on a Sailboat

Many people choose the liveaboard lifestyle because they believe it saves money. That's said, poor financial management can make living aboard cost more than living in an apartment or house. Proper budgeting and regular upkeep are essential to keep your liveaboard lifestyle affordable and comfortable.

Budgeting on a sailboat follows the same basic principles as any other kind of budgeting. However, the specifics are different, as a sailboat is a floating vehicle that has unique maintenance and living requirements.

Boat Payments

Many people make payments on their boats. Financing a liveaboard sailboat is common practice, and you should budget these payments the same way you'd budget a car payment or even the mortgage. Be sure to factor in boat payments when making your budget, as it should be a top priority when cash is tight.

Boat Insurance, while not mandatory in most places, can actually make your budget more secure despite the recurring expense. Sailboat insurance is generally inexpensive and rarely costs more than a few hundred dollars per year.

It provides peace of mind and protection from accidents that can easily cost thousands. Part of budgeting is preparing for unexpected costs, and boat insurance can eliminate one of the largest emergency boat expenses.

Cruising vs. Permanent Mooring

How do you plan on using your sailboat? A moored sailboat has vastly different requirements than a cruising sailboat. Cruising, whether short or far, requires several additional resources that you'll need to budget for. Remember, these requirements are in addition to regular maintenance, which will cover later in this article.

Up-to-date navigational equipment is essential if you plan to cruise on your sailboat. In the 21st century, people rely primarily on digital navigation systems when setting sail. The old tools and methods are important but less expensive to acquire, so we'll focus on Modern systems.

The most basic modern GPS chart systems cost between $250 and $1,000. These systems become obsolete somewhat quickly, so you should plan to update them once every five or ten years. More advanced navigation instruments, such as radar, last longer but cost significantly more. If you intend to use radar, plan to spend between $1,500 and $3,000 for the system and occasional maintenance.

Another consideration for cruising sailboats is rigging. In this case, we'll also include items such as sails, furling systems, winches, and other working hardware that's necessary for sailing.

Plan for regular maintenance and occasional replacement, as the consequences of rigging failure can be catastrophic. Be sure to budget for replacement canvas, tools, stays, lines, and other items that need attention before (or after) getting underway.

Dockside Liveaboard Budgeting

If you plan on spending most of your time at the dock, you don't have to worry as much about rigging and operational expenses. Instead, your expenses will likely resemble those of living in an apartment or a house.

Docking Fees

Docking fees, or slip fees, are the expenses paid to dock your boat at a marina or yacht club. Docking fees vary widely between states, cities, and establishments. Usually, docking and slip fees are calculated by an overall boat length. Additional expenses may apply to unusually wide boats, such as catamarans and trimarans.

You should budget slip fees the same way you budget a rent payment or a mortgage. Similarly, if you fail to pay your dock or slip fees, your vessel could be evicted from its mooring. Slip fees should be a top priority on your liveaboard sailboat budget.

Utilities include everything from electricity to freshwater. These connections are available only on the dock, though sailboats can generate their own electricity using their engine, solar panels, wind turbines, and other sources. Liveaboards typically connect to shore power, water, and sewage, as it requires virtually no initial expense.

Budgeting for utilities is typically fairly easy for liveaboards. This is because shore connections are often included in the price of mooring. If they're not included, you can talk to the marina and get an idea of how much you'll spend.

Fuel expenses are also a factor for liveaboards, even if they rarely move the boat. This is because fuel includes both gasoline or diesel for the engine (which should always be operational) and also propane or kerosene for heating and cooking.

Some boat stoves and heaters use mineral spirits (alcohol), so that should also be considered. There are no hookups for cooking and heating fuel at marinas, so it must be hauled in manually.

If you live aboard in an area with cold weather, such as the Pacific Northwest or the Northeast, you should allocate a considerable amount of your budget to heating fuel. Additionally, consider converting your appliances to run on the same fuel. For example, if you have a kerosene stove, consider installing a kerosene heater as well. This can simplify the budgeting process as only one fuel type has to be acquired.

Maintenance

Apart from slip fees, maintenance is likely the largest expense you'll need to budget for. It is also incomparable to home maintenance, as very few of the same tasks apply. Regular maintenance is essential and will prevent costly repairs down the line.

Safety Equipment

The U.S. Coast Guard requires several pieces of safety equipment to be aboard your boat at all times, whether moored at a marina or out at sea. Many of these items have a limited service life and must be checked and replaced regularly. These items include fire extinguishers, life jackets, flares, among others.

Engines are the source of some of the highest maintenance expenses aboard a sailboat. This is especially true for inboard motors, which must be maintained in tight spaces. It's essential to keep your engine running well. Oil changes, cooling system inspections, repairs, and filter replacements must occur regularly.

The hull of a sailboat is a magnet for undesirable sea life, such as barnacles, muscles, and other growth. Though the hull itself is quite resilient, marine growth can weigh down the boat, immobilize the propeller, damage the rudder, and cause other issues, especially while underway. The hull must be scraped and painted periodically, which can be considerably expensive. This should be included in the budget once every year or two.

Additionally, oxidation occurs on fiberglass hulls which need to be addressed periodically. This process can be done about the waterline and does not always require hauling out. Refinishing kits are available, and you can do it yourself to reduce the cost.

The deck is another source of maintenance costs that are often overlooked. The cost time required to maintain your deck depends on what kind of deck you have. A teak deck, for example, can be maintained yourself, but it's more labor-intensive than a fiberglass deck. Be sure to factor in the cost of chemicals and tools when budgeting for deck maintenance.

Wiring typically doesn't require maintenance in the traditional sense, though it will need to be serviced periodically. Marine electrical systems required fuses, bulbs, and other items that deteriorate faster in a saltwater-rich environment than they do on land. Factor in a few hundred dollars per year for miscellaneous electrical parts.

Hauling Out

Hauling out is an essential part of hull maintenance that's costly enough to include as a separate category. Your vessel will need to be hauled out once every couple of years to scrape and paint the bottom, along with performing any repairs that can't be done in the water. Hauling out is an extensive process that can cost several thousand dollars, but it isn't required very often.

Chemicals are surprisingly expensive and must be budgeted accordingly. Items such as fiberglass and resin, which are essential aboard any sailboat, can cost upwards of $100 per gallon. Several gallons could be required to complete a repair job.

Other compounds, such as paint, spar varnish, and cleaning supplies, should also be factored in. In most cases, $1,000 per year or so should cover most chemical expenses. Storing chemicals properly helps preserve them and reduce costs over time.

Most liveaboards agree that you should have a few grand tucked away for repairs each year. Things break on a sailboat, and this is especially inconvenient if the vessel doubles as your home. We've already covered chemicals for fiberglass repair, so let's go over some of the other sources of surprise repair costs.

Pipes and Plumbing

Plumbing issues are common on sailboats. Leaky showerheads, clogged toilets, and tank issues happen occasionally and must be repaired. Luckily these issues are usually not particularly expensive or complex to fix.

Sailboats must furnish their own water pressure and include systems the pump out the bilge. Potable water pumps and bilge pumps are electric and have a limited service life, which means you'll need to replace them eventually.

Cabinets, doors, gimbals, and other interior furnishings break from time to time. Budget a few hundred dollars each year for wood, stain, hinges, screws, and other miscellaneous hardware to repair interior fixtures if they break.

Leaks occur on sailboats; it's just part of life. Leaks are also the most annoying problems to fix and can be very costly and urgent. It's best to factor in some of your savings to repair leaks in the hull and the deck. Don't ignore leaks around portlights and vents, as water ingress can cause mold and quietly weaken the fiberglass structure of your vessel.

Mechanical Systems

Mechanical and electromechanical systems such as the engine, blowers, and hydraulics sometimes fail and need repair. These systems are the most costly to repair on a sailboat. They can eat up a considerable amount of your maintenance budget in a short period of time. Regular inspection and maintenance are key to preventing unwelcome mechanical issues.

Experienced sailors often already have all the tools they need to maintain and repair their boat. But if you're new to the liveaboard lifestyle, you're going to need to equip yourself with all the required implements for maintaining your vessel.

Along with basic tools, such as screwdrivers, a power drill, and wrenches, you'll also need tools to work with fiberglass, wiring, and plumbing. Most of these tools are available for discounted prices at yard sales, pawnshops, and local marketplaces.

Transportation

Transportation is an important factor to consider when living aboard a sailboat. Some sailors choose to keep a car, especially if they continue to work a traditional job in a city. This poses unique challenges in that it adds car payments, insurance payments, and fuel to the equation. Additionally, some marinas don't allow parking for free.

Ride-sharing apps such as Uber and Lyft are an alternative, but this adds up quickly. Some sailors choose to take public transportation or ride a bicycle, which can reduce the long-term load on your budget.

Sample Liveaboard Budget

Now that we've covered the basic expenses to expect when living aboard, we'll put together a sample liveaboard budget. The figures are based on someone making a monthly income of $4,000 docking a 30-foot sailboat at a reasonably priced marina.

As you can see, a well-proportioned budget leaves plenty of wiggle room for personal expenses, saving, and stashing money away for larger unexpected expenses. These prices may not reflect your individual situation, but the point remains the same. A balanced budget can make living aboard a sailboat affordable and enjoyable.

Related Articles

I've personally had thousands of questions about sailing and sailboats over the years. As I learn and experience sailing, and the community, I share the answers that work and make sense to me, here on Life of Sailing.

by this author

Financial and Budgeting

Most Recent

What Does "Sailing By The Lee" Mean?

October 3, 2023

The Best Sailing Schools And Programs: Reviews & Ratings

September 26, 2023

Important Legal Info

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies.

Similar Posts

Best Bluewater Sailboats Under $50K

December 28, 2023

How To Choose The Right Sailing Instructor

August 16, 2023

Cost To Dock A Sailboat

May 17, 2023

Popular Posts

Best Liveaboard Catamaran Sailboats

Can a Novice Sail Around the World?

Elizabeth O'Malley

4 Best Electric Outboard Motors

How Long Did It Take The Vikings To Sail To England?

10 Best Sailboat Brands (And Why)

December 20, 2023

7 Best Places To Liveaboard A Sailboat

Get the best sailing content.

Top Rated Posts

Lifeofsailing.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon. This site also participates in other affiliate programs and is compensated for referring traffic and business to these companies. (866) 342-SAIL

© 2024 Life of Sailing Email: [email protected] Address: 11816 Inwood Rd #3024 Dallas, TX 75244 Disclaimer Privacy Policy

- 0 No item in your cart

- SUBSCRIPTION

- Classified Ads

- Technical Specifications

- Destinations

- Address book

- All the magazines

Financing your Catamaran or Trimaran

Article published on 22/06/2019

published in n°13 aug. / sept.

Buying a multihull is a major investment, and usually bigger for the same length vessel than for a monohull. Classic loan, lease-option deal, charter-management… What are the options? And what is the fiscal situation with each option?

Create a notification for "Technical"

We will keep you posted on new articles on this subject.

When we talk about two or three hulls, the price goes up, and often requires a loan. Given the low interest rates available at the moment (around 4-5%) taking on a loan to finance your project looks like an increasingly interesting option. In some cases, a loan can have an impact on the legal and fiscal status of your multihull. When buying a boat, whether as a private individual or as a company, the banks offer two possibilities: a loan or a lease-option deal. The loan needs to be secured by a maritime or property mortgage if the risk is high. You are the boat owner and the boat’s documents are in your name. This applies to new and second-hand boats. The length of the loan can be as long as 25 years, although the average is 10. In practice it’s possible to finance a 10-year-old boat over 15 years. The deposit is usually 20-30% and the depreciation schedule can evolve based upon your situation. For example, you can have smaller monthly payments throughout the year, and one big payment at the end to coincide with your dividends being paid out. Each bank has its own particularities, and advice from an independent broker, like Jérôme Wydauw of W.Lease, can be really useful when looking for an offer which suits your needs and constraints. There is also the question of insurance to be considered.

Leasing: Two Different Possibilities

The other type of loan is leasing. Leasing is only available for companies, and the Lease-Option deal is available to companies and private individuals. In this case, it is the bank or lender who buys the boat in their name and charters it to you over a fixed term which is decided at the outset (3 to 15 years maximum). You will then have the possibility to become the owner at the end of the period by paying off the purchase option, which is stipulated in the original contract, as a final charter payment. In some cases, the initial downpayment (1st charter payment) can be considered as the buyback amount. Watch out though. This format is not systematic with all leasing contracts. There are several advantages. The boat cannot be seized by any creditor other than the lender. It does not count as part of the charterers personal wealth and is not subject to a wealth tax in the countries where it applies. For a company, the rents are depreciable and the sales tax applies to everyone. For the period that the charterer is not the owner, he or she is still responsible for the boat, in particular if there is a law violation or an accident. In Europe, it is the lender who pays the sales tax, and they will then possibly pass this cost on to the renter through the rents, either partially or sometimes not at all. Two sales tax régimes are possible: a fixed amount or the real amount. Given that cruising boats are often outside territorial waters (+ 6 miles from the coast), the government offers a 50% reduction in the sales tax on the charter. The fixed rate is therefore 10% instead of 20% in France. Since 2006, the sales ...

Subscribe to Multihulls World and get exclusive benefits.

Did you like this article ?

Share this article

Most-read articles in the same category.

Who's Who - Nigel Irens: A wonderful, self-taught naval architect

A Wonderful Nautitech Gateway - An Owners’ Meet Up in Martinique

International Multihull Show - The unmissable get-together for multihull fans

The photographer's eye - Rivergate Marina, Brisbane, Australia: Customs Clearance!

2023 Sail Buyer's Guide - Multihulls from 30 to 40 feet

2023 Sail Buyer's Guide - Multihulls from 20 to 30 feet

What readers think.

Post a comment

No comments to show.

Follow us on

Vous avez ajouté " " à vos favoris., vous avez supprimé " " de vos favoris., in order to add this article to your favorites, please sign in..

- About Aeroyacht

- Aeroyacht Design

- Aeroyacht TV

- Mission Statement & Privacy Policy

- Aeroyacht Racing

- Favorite Links

- Customer Testimonials

- Office Location

- BUY A MULTIHULL

- Specifications

- Photo Gallery

- Try Before You Buy

- Yacht Ownership and Demo Sails

- BUY A POWER CATAMARAN

- Yacht Business Ownership FAQ

- MULTIHULLS FOR SALE

- Aeroyacht Superyacht Catamarans

- Global Multihull Search

- Buy A Multihull

- Sell a Multihull

- Multihull News

- Publications & Articles

- Commissioning & Delivery Services

- Catamaran Financing Calculator

contact Aeroyacht to discuss your Catamaran Financing

- Multihull Services

- Catamaran Surveys

- Catamaran Build Consultation

- Financing Services

- Catamaran Repair & Service Facilities

- Catamaran Demo Rides & Shows

- Catamarans for China

- Yacht Design

- Interior Styling & Yacht Art

- Photography

Catamaran News

The Stunning Interior Design of the McConaghy Multihull Range

Nautitech Spareparts – Order Simple and Quick

For Immediate Delivery – Nautitech 44 Owner Version

Yannick Bestaven’s NEEL 47 Trimaran

Conser 47/50′ FOR SALE

- Catamaran Steering Positions

- Catamarans vs. Monohulls

- Catamaran Learning Center

- Catamaran Speed

- Catamaran Efficiency

- Catamaran Stability

- Catamaran Safety

- Catamaran Shallow Draft

- Catamaran No Heel Sailing

- Catamarans and Seasickness

- Catamaran Space

- Catamaran Boat Handling

- Catamaran Advantages over Monohulls

- Wave-Piercing Bows

- Catamaran Sailing Schools

- Catamaran Insurance

- Catamaran Charter Business and Tax Savings

- Ask the Owner

- 5 Valuable Tips

- Survey Checklist

- Sea Trial Checklist

- MULTIHULLS & CATAMARANS App for Iphone

- Catamaran Repair & Service Facilities

- Catamaran Demo Rides & Shows

- Interior Styling & Yacht Art

Planet Sail tests a McConaghy Multihull

Charles Caudrelier wins Arkea Ultim Challenge

Nautitech 48 – Control of the Wind

Boat Test: Nautitech 48 Open catamaran

NEEL 52 Trimaran VIDEO – Sailing at 17 knots

McConaghy MC63 Power Tourer – showing her pace

Nautitech 48 Open catamaran – Video

Nautitech 48 catamaran – Interior Design

How the Nautitech 48 catamaran was conceived – Designer Comments.

Launched ! – McConaghy MC82P Power

Helpful tips from aeroyacht.

AEROYACHT PUBLICATIONS

Catamaran books by gregor tarjan.

JOIN AEROYACHT’S NEWSLETTER

- BOAT OF THE YEAR

- Newsletters

- Sailboat Reviews

- Boating Safety

- Sailing Totem

- Charter Resources

- Destinations

- Galley Recipes

- Living Aboard

- Sails and Rigging

- Maintenance

Buying a Charter Catamaran

- By Tim Murphy

- Updated: August 26, 2019

There’s one math problem that almost no boat owner ever wants to calculate: cost of ownership divided by actual days spent sailing. A stance of cheerful delusion might be the best way to accept the hard answer.

This is the problem charter yacht-ownership programs are designed to solve. If you talk with folks who’ve spent many years in the business of selling new boats into charter fleets and operating those fleets, you can expect to hear several cautionary themes: A sailboat is a depreciating asset; owning a charter boat is more a lifestyle choice than a financial investment; beware the aggressive tax-benefit pitch. Yet, by and large, they agree on this: If you love sailing and love traveling but you know that—for the next five years, at least—you won’t be able to devote more than four or eight or maybe even 12 weeks to it, placing a boat in charter will substantially offset the cost of owning it.

Consider this ballpark example from Dream Yacht Charter’s new Fractional Program, introduced this past fall. You put down roughly $200,000 for a 25 percent share in a new 45-foot Bali 4.5 catamaran. In exchange, for the five-year agreement, Dream Yacht covers all of the boat’s operating expenses (dockage, maintenance, insurance and so on), and you receive five weeks’ use on any similar boat at any of Dream Yacht’s 50 bases around the world. Every year of the contract, Dream Yacht sends you 5 percent of your buy-in price: $10,000 per year, or $50,000 over five years. Toward the end of the term, Dream Yachts lists the boat on the open market. If it sells before the end of the charter agreement, you receive your portion of the proceeds. If it doesn’t, Dream Yacht guarantees a 40 percent minimum buy-back value at resale, or $80,000. According to this math ($50,000 plus $80,000), by the end of the five-year term, you get $130,000 back from your original investment, and your total cost amounts to $70,000.

Now here’s where the sailing comes in. The average cost of chartering a Bali 4.5 is about $8,000 per week. The value of chartering a Bali 4.5 for two weeks per year over five years comes to $80,000; four weeks per year, $160,000; five weeks per year, $200,000. The takeaway: If you can go sailing for four weeks a year, with this program, you receive $160,000 in value for the $70,000 you spent. (And the ratio looks better still if you can get out sailing for five weeks a year.)

We’ve looked into the ownership programs offered by several of the major charter companies and charter-management companies around the world. These can be roughly divided into two categories: guaranteed income, or passive models; and variable income, or active models (in which you assume more of a role in managing your boat as a business). In addition, many charter companies offer other programs adapted to such special circumstances as crewed charters, fractional ownership, and special circumstances for particular countries. Each company has its particular quirks; we’ll aim to give an overview from which you can start your own conversations.

The Passive Model: Guaranteed Income

Full-scale bareboat chartering is just over 50 years old. Before that, you could always find a boat to charter directly from its owner or from a small mom-and-pop operation. But the business as we’d recognize it today began when Jack van Ost founded Caribbean Sailing Charters in Tortola in 1967. Dick Jachney soon followed with Caribbean Yacht Charters in St. Thomas, then Charlie and Ginny Cary started the Moorings in Tortola in 1969.

Jean Larroux has been with the Moorings, on and off, since 1976. Now the company’s yacht sales manager, Larroux is credited with creating the “guaranteed income” model that has become the most popular plan among the world’s largest charter companies.

“Before Ronald Reagan changed the tax laws in 1986, we used to sell basically only variable programs,” Larroux said. “But as the Moorings’ fleet grew, the appetite for boats was such that it was difficult with the variable program to find enough buyers. We sell 150 to 200 boats a year. So we found that to be able to sell that number of boats, we had to focus mainly on a program in which there was virtually no risk.”

The Moorings Guaranteed Income program works like this: You buy the boat and pay the registration fee. The Moorings leases it back for an agreed-upon term—more or less than 60 months, scheduled so the boat doesn’t come out of service during the chartering high season. During that period, the Moorings pays you 9 percent of the purchase price annually, broken into monthly installments. Those payments do not depend on how often your particular boat has been chartered. The company covers all operating costs: dockage, insurance and maintenance. As for sailing, the Moorings offers you as much as 12 weeks of chartering each year, depending on the season, and allows you to use any equivalent boat at any of the company’s bases. The only cost to you is a nominal turnaround fee to cover consumables (water, ice and fuel) each time you start a charter trip.

A ballpark example might look like this: You purchase a 50-foot Moorings 5000 catamaran for $1,000,000. You put down 25 percent and finance $750,000 for 15 years at 6 percent interest. Your monthly payment on the loan comes to about $6,300; each month, the Moorings pays you $7,463 for the lease. If you apply the entire fee to the loan each month, by the end of the term, you’ll owe $505,460. The Moorings estimates the boat’s resale value after five years at $580,000. And, as in our earlier example, the true value comes in sailing weeks—as much as $550,000 worth of chartering over those five years.

Nowadays, most large charter companies and some smaller ones offer a version of the guaranteed-income model. One constraint of this model is the charter company is likely to require that you spec out the boat for optimum charter appeal. If a 45-footer is offered with three cabins or four, for example, it’s likely that you’ll need to go with four. Compare companies.

The charter company you choose might steer you toward a particular make of catamaran. The Moorings sells mainly Robertson & Caine catamarans, branded as either Moorings or Sunsail boats. Dream Yacht sells Bali, Fountaine-Pajot and Lagoon. Horizon Yacht Charters sells Nautitech, Lagoon and Fountaine-Pajot. Navigare sells Fountaine-Pajot, Lagoon, Nautitech and Sunreef.

The Active Model: Variable Income

Before the advent of guaranteed-income programs, virtually all charter arrangements were on the variable-income model, and most companies still offer some version of it today. In this case, the costs and proceeds of chartering begin and end with your particular boat. It offers the flexibility for you to either use your boat more often—or use it less, and potentially make more money from it. It also gives you an active role of running your boat as a business, which might have tax implications. (There are no tax breaks for such passive investments as the guaranteed-income model.)

The Catamaran Company is a charter-management company that works exclusively on the variable-income model. Whereas guaranteed-income programs might dictate the way your boat will be laid out and appointed, CatCo offers its owners unlimited choice. “What is always going to charter best,” said Hugh Murray, CEO of CatCo, “is the boat you can put more people on for the cheaper price. So the income projections for an owner buying a four-cabin boat will be higher than for the owner of a three-cabin boat. But in a lot of cases, our owners are likely to want fewer weeks rather than more weeks.”

With a variable program, the boat owner covers all the costs of operating the boat, and the charter operator splits all the income from charters, with the larger portion going to the owner. Horizon Yacht Charters splits 80 percent (to the owner)/20 percent (to the company). CatCo splits 77 percent/23 percent. Dream Yachts and the Moorings split 65 percent/35 percent.

Typically, the charter operator sends the boat owner a statement every month, detailing the charter revenue and the boat’s expenses (docking, water, maintenance, turnaround, electricity, repairs, cleaning and laundry). This statement comes with either a check or a bill. “It goes both ways,” Murray said, “depending on what time of year their boat arrives in the fleet. If a boat arrives in December and starts chartering immediately, you’ll start to get good revenue. If your boat arrives in July, and there’s very little happening in August, September and October, you’re getting a bill.” On average, he says most owners see a return of 9 or 10 percent of the boat’s purchase price per year.

What about tax breaks? Jean Larroux told me that the Moorings does not actively market them as an incentive. “It’s marginal whether you’ll survive a tax audit,” he said.

Others I spoke to concur. “We do not market the tax benefits whatsoever,” Murray said. “If somebody wishes to do it, we’re happy to refer them to tax consultants.”

That said, each person I spoke to said they had some clients who were able to make tax benefits work with a variable program. “That’s exactly the difference between our guaranteed-income and our Performance programs,” said Eric Macklin, yacht sales manager for Dream Yacht Charter, referring to the name Dream Yacht gives to its variable-revenue model. The IRS, Macklin says, sets two benchmarks. The first is that the boat owner has to be “actively participating” in the business. The second is that the owner has to show the intention and the ability to earn a profit. As others do, he recommends working closely with a tax adviser first.

The takeaway is that a variable-revenue program might offer you more flexibility in every aspect of owning a boat in charter service: how you spec your boat, how often you use your boat, and how active you’d like to be in the business.

Alternative Models